An MSR-Focused REIT First Quarter 2025 Earnings Call Presentation April 29, 2025

Safe Harbor Statement 2 FORWARD-LOOKING STATEMENTS This presentation of Two Harbors Investment Corp., or TWO, includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2024, and any subsequent Quarterly Reports on Form 10-Q, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: the state of credit markets and general economic conditions; changes in interest rates and the market value of our assets; changes in prepayment rates of mortgages underlying our target assets; the rates of default or decreased recovery on the mortgages underlying our target assets; declines in home prices; our ability to establish, adjust and maintain appropriate hedges for the risks in our portfolio; the availability and cost of our target assets; the availability and cost of financing; changes in the competitive landscape within our industry; our ability to effectively execute and to realize the benefits of strategic transactions and initiatives we have pursued or may in the future pursue; our decision to terminate our management agreement with PRCM Advisers LLC and the ongoing litigation related to such termination; our ability to manage various operational risks and costs associated with our business, including the risks associated with operating a mortgage loan servicer and originator; interruptions in or impairments to our communications and information technology systems; our ability to acquire mortgage servicing rights (MSR) and to maintain our MSR portfolio; our exposure to legal and regulatory claims; legislative and regulatory actions affecting our business; our ability to maintain our REIT qualification; and limitations imposed on our business due to our REIT status and our exempt status under the Investment Company Act of 1940. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. TWO does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in TWO’s most recent filings with the Securities and Exchange Commission (SEC). All subsequent written and oral forward- looking statements concerning TWO or matters attributable to TWO or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. This presentation may include industry and market data obtained through research, surveys, and studies conducted by third parties and industry publications. We have not independently verified any such market and industry data from third-party sources. This presentation is provided for discussion purposes only and may not be relied upon as legal or investment advice, nor is it intended to be inclusive of all the risks and uncertainties that should be considered. This presentation does not constitute an offer to purchase or sell any securities, nor shall it be construed to be indicative of the terms of an offer that the parties or their respective affiliates would accept. Readers are advised that the financial information in this presentation is based on company data available at the time of this presentation and, in certain circumstances, may not have been audited by the company’s independent auditors.

Book Value per Share $14.66 Common Stock Dividend $0.45 Economic Return on Book Value(1) 4.4% Comprehensive Income per Share $0.62 Investment Portfolio(2) $14.6b Quarter-End Economic Debt-to-Equity(3) 6.2x Note: Financial data throughout this presentation is as of or for the quarter ended March 31, 2025, unless otherwise noted. Per share metrics utilize basic common shares as the denominator. The End Notes are an integral part of this presentation. See slides 29 through 33 at the back of this presentation for information related to certain financial metrics and defined terms used herein. Quarterly Financials Overview 3

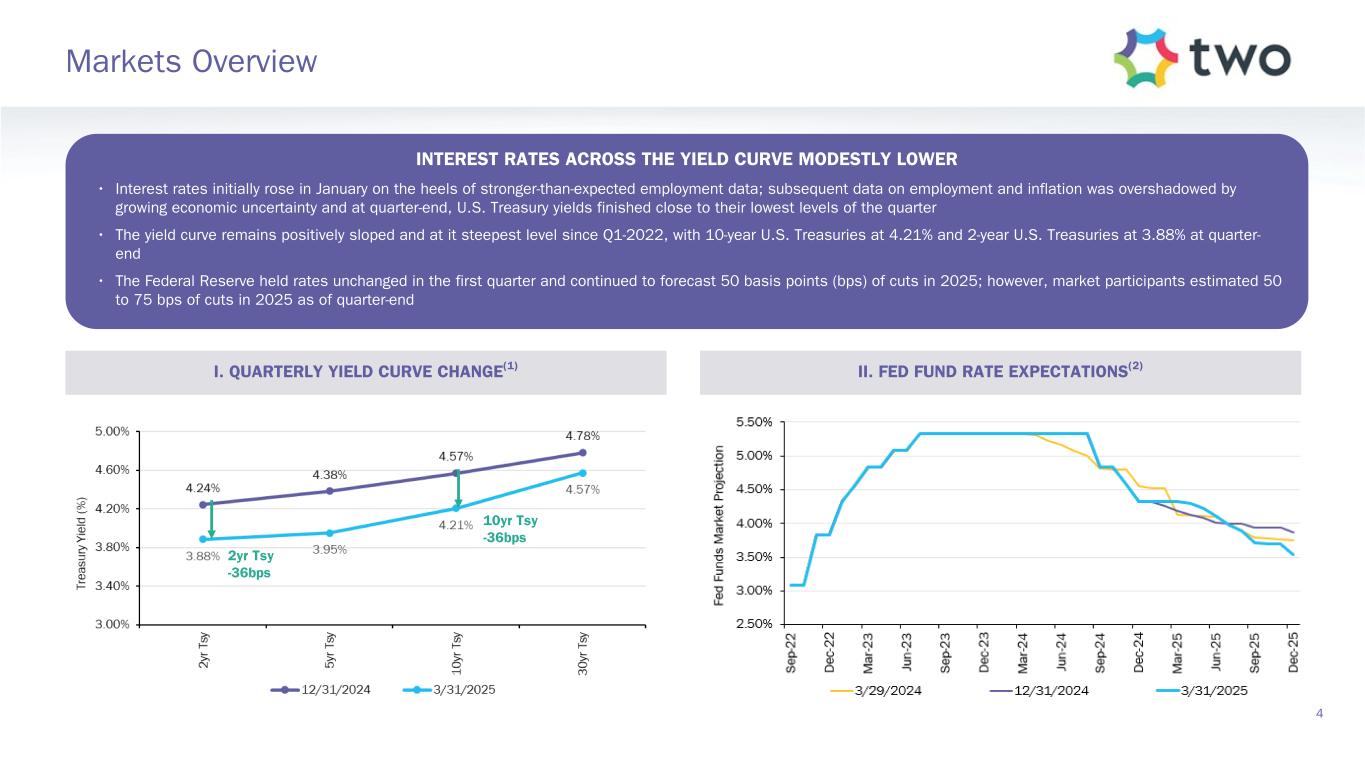

4 Markets Overview I. QUARTERLY YIELD CURVE CHANGE(1) INTEREST RATES ACROSS THE YIELD CURVE MODESTLY LOWER • Interest rates initially rose in January on the heels of stronger-than-expected employment data; subsequent data on employment and inflation was overshadowed by growing economic uncertainty and at quarter-end, U.S. Treasury yields finished close to their lowest levels of the quarter • The yield curve remains positively sloped and at it steepest level since Q1-2022, with 10-year U.S. Treasuries at 4.21% and 2-year U.S. Treasuries at 3.88% at quarter- end • The Federal Reserve held rates unchanged in the first quarter and continued to forecast 50 basis points (bps) of cuts in 2025; however, market participants estimated 50 to 75 bps of cuts in 2025 as of quarter-end 2yr Tsy -36bps 10yr Tsy -36bps II. FED FUND RATE EXPECTATIONS(2)

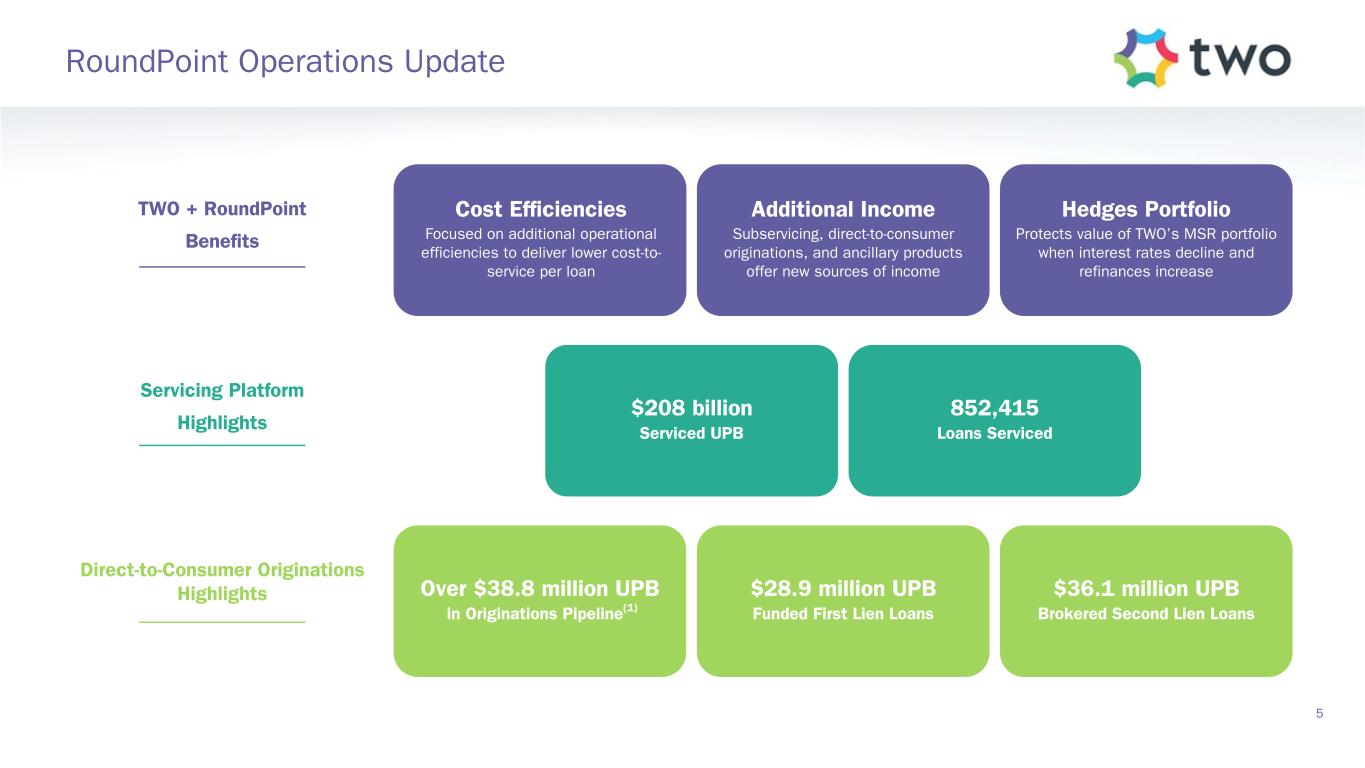

Over $38.8 million UPB in Originations Pipeline(1) $208 billion Serviced UPB 852,415 Loans Serviced Hedges Portfolio Protects value of TWO’s MSR portfolio when interest rates decline and refinances increase Cost Efficiencies Focused on additional operational efficiencies to deliver lower cost-to- service per loan Additional Income Subservicing, direct-to-consumer originations, and ancillary products offer new sources of income RoundPoint Operations Update 5 $28.9 million UPB Funded First Lien Loans Direct-to-Consumer Originations Highlights Servicing Platform Highlights TWO + RoundPoint Benefits $36.1 million UPB Brokered Second Lien Loans

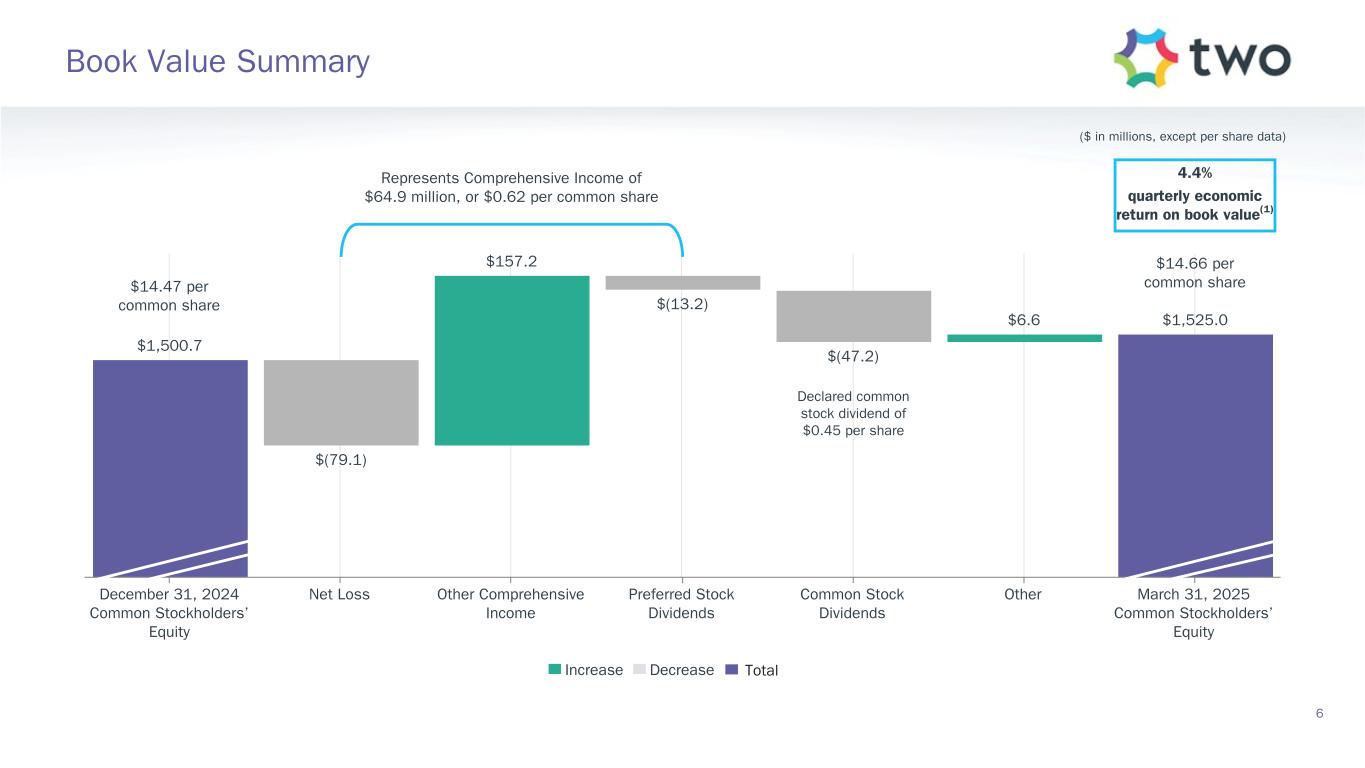

$1,500.7 $(79.1) $157.2 $(13.2) $(47.2) $6.6 $1,525.0 December 31, 2024 Common Stockholders’ Equity Net Loss Other Comprehensive Income Preferred Stock Dividends Common Stock Dividends Other March 31, 2025 Common Stockholders’ Equity ($ in millions, except per share data) $14.47 per common share $14.66 per common share Represents Comprehensive Income of $64.9 million, or $0.62 per common share Declared common stock dividend of $0.45 per share Increase Decrease Total Book Value Summary 6 4.4% quarterly economic return on book value(1)

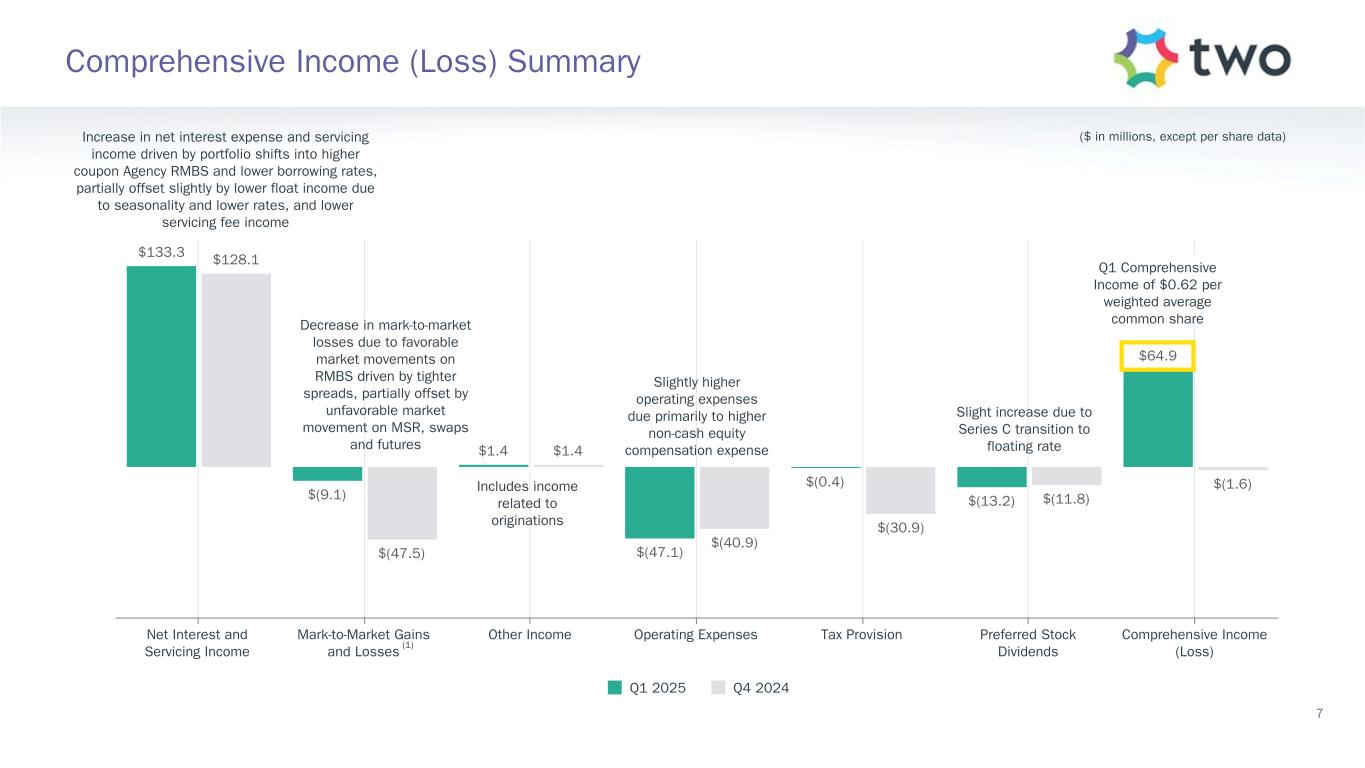

$133.3 $(9.1) $1.4 $(47.1) $(0.4) $(13.2) $64.9 $128.1 $(47.5) $1.4 $(40.9) $(30.9) $(11.8) $(1.6) Q1 2025 Q4 2024 Net Interest and Servicing Income Mark-to-Market Gains and Losses Other Income Operating Expenses Tax Provision Preferred Stock Dividends Comprehensive Income (Loss) Comprehensive Income (Loss) Summary 7 ($ in millions, except per share data) Q1 Comprehensive Income of $0.62 per weighted average common share Slightly higher operating expenses due primarily to higher non-cash equity compensation expense Includes income related to originations Decrease in mark-to-market losses due to favorable market movements on RMBS driven by tighter spreads, partially offset by unfavorable market movement on MSR, swaps and futures Increase in net interest expense and servicing income driven by portfolio shifts into higher coupon Agency RMBS and lower borrowing rates, partially offset slightly by lower float income due to seasonality and lower rates, and lower servicing fee income Slight increase due to Series C transition to floating rate (1)

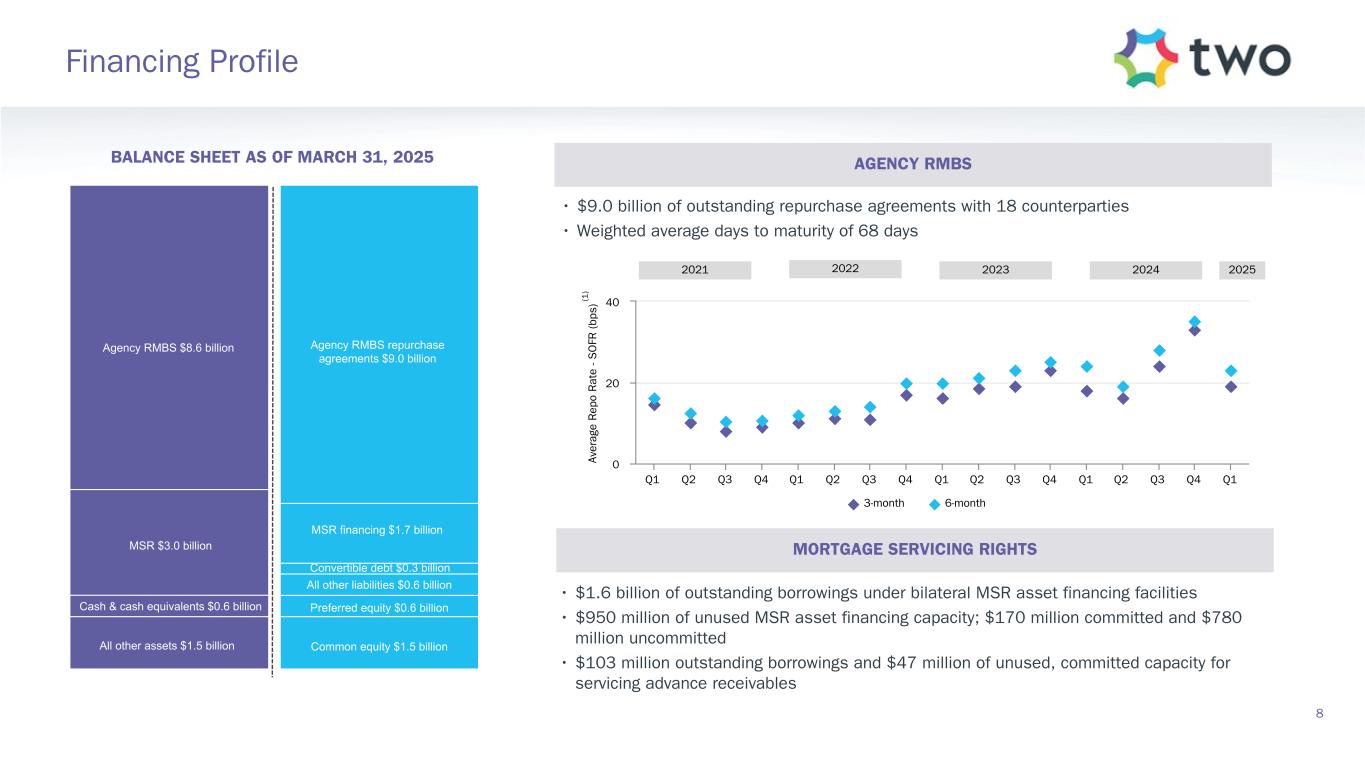

• $1.6 billion of outstanding borrowings under bilateral MSR asset financing facilities • $950 million of unused MSR asset financing capacity; $170 million committed and $780 million uncommitted • $103 million outstanding borrowings and $47 million of unused, committed capacity for servicing advance receivables BALANCE SHEET AS OF MARCH 31, 2025 • $9.0 billion of outstanding repurchase agreements with 18 counterparties • Weighted average days to maturity of 68 days Av er ag e R ep o R at e - S O FR ( bp s) 3-month 6-month Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 0 20 40(1 ) Agency RMBS $8.6 billion MSR $3.0 billion Cash & cash equivalents $0.6 billion All other assets $1.5 billion Agency RMBS repurchase agreements $9.0 billion MSR financing $1.7 billion All other liabilities $0.6 billion Preferred equity $0.6 billion Common equity $1.5 billion Convertible debt $0.3 billion 2021 2022 2023 2024 Financing Profile 8 AGENCY RMBS MORTGAGE SERVICING RIGHTS 2025

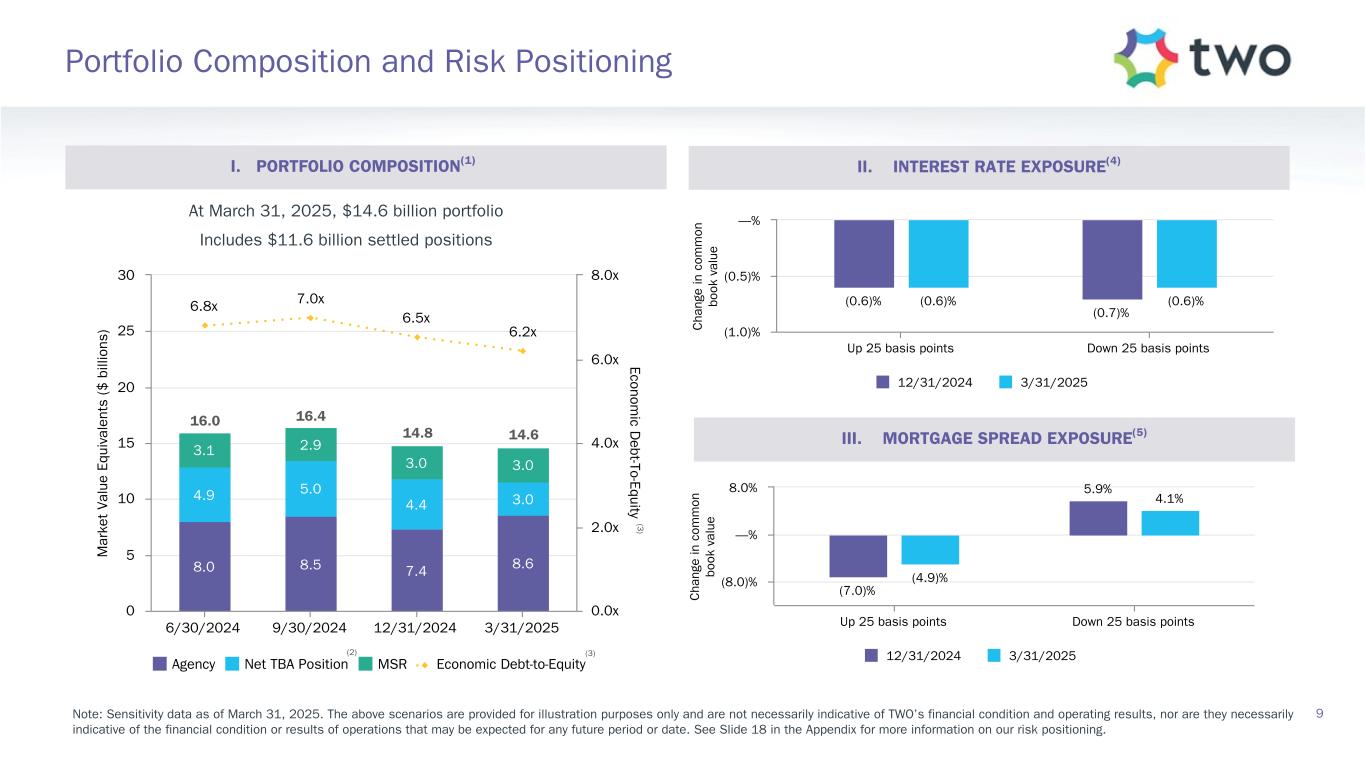

At March 31, 2025, $14.6 billion portfolio Includes $11.6 billion settled positions M ar ke t Va lu e Eq ui va le nt s ($ b ill io ns ) Econom ic D ebt-To-Equity 8.0 8.5 7.4 8.6 4.9 5.0 4.4 3.0 3.1 2.9 3.0 3.0 6.8x 7.0x 6.5x 6.2x Agency Net TBA Position MSR Economic Debt-to-Equity 6/30/2024 9/30/2024 12/31/2024 3/31/2025 0 5 10 15 20 25 30 0.0x 2.0x 4.0x 6.0x 8.0x (3) (3 ) (2) 14.614.8 16.0 16.4 Note: Sensitivity data as of March 31, 2025. The above scenarios are provided for illustration purposes only and are not necessarily indicative of TWO’s financial condition and operating results, nor are they necessarily indicative of the financial condition or results of operations that may be expected for any future period or date. See Slide 18 in the Appendix for more information on our risk positioning. C ha ng e in c om m on bo ok v al ue (0.6)% (0.7)% (0.6)% (0.6)% 12/31/2024 3/31/2025 Up 25 basis points Down 25 basis points (1.0)% (0.5)% —% C ha ng e in c om m on bo ok v al ue (7.0)% 5.9% (4.9)% 4.1% 12/31/2024 3/31/2025 Up 25 basis points Down 25 basis points (8.0)% —% 8.0% 9 Portfolio Composition and Risk Positioning I. PORTFOLIO COMPOSITION(1) II. INTEREST RATE EXPOSURE(4) III. MORTGAGE SPREAD EXPOSURE(5)

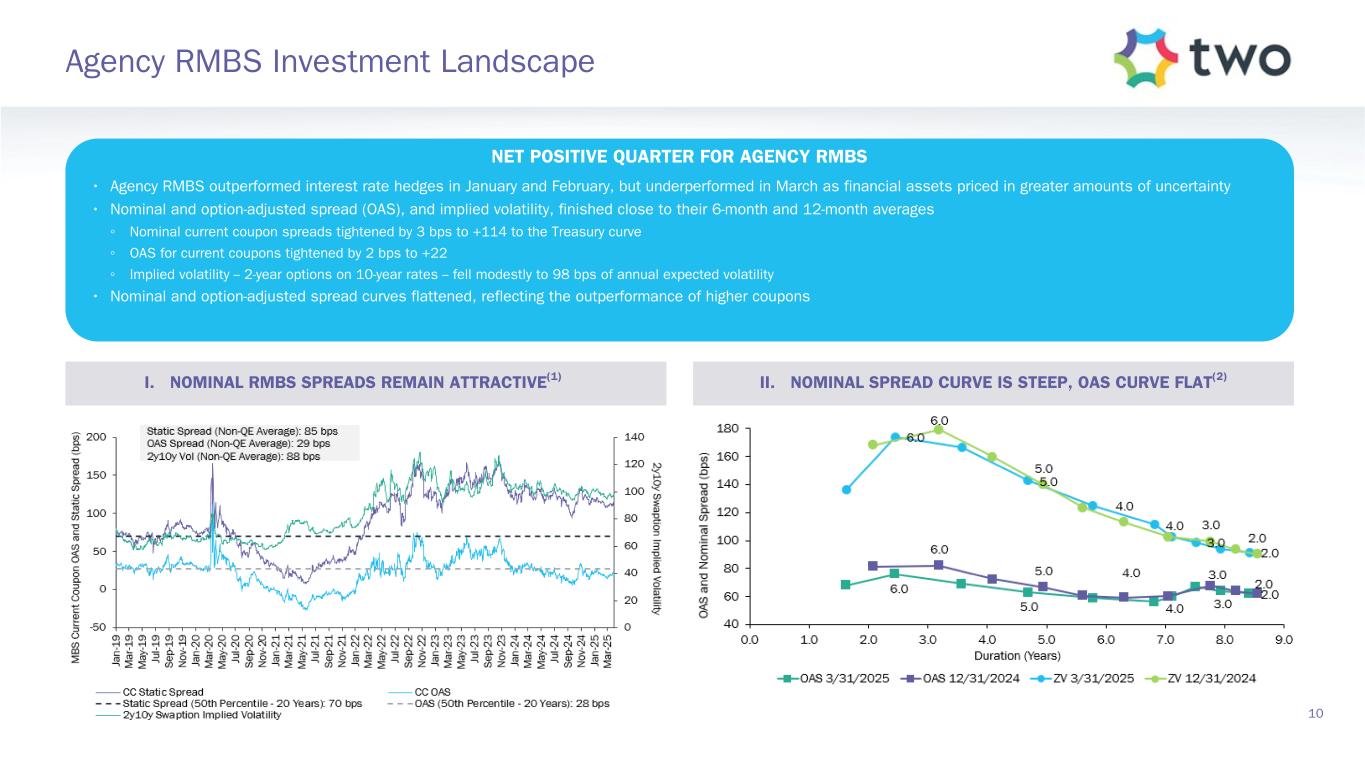

10 Agency RMBS Investment Landscape NET POSITIVE QUARTER FOR AGENCY RMBS • Agency RMBS outperformed interest rate hedges in January and February, but underperformed in March as financial assets priced in greater amounts of uncertainty • Nominal and option-adjusted spread (OAS), and implied volatility, finished close to their 6-month and 12-month averages ◦ Nominal current coupon spreads tightened by 3 bps to +114 to the Treasury curve ◦ OAS for current coupons tightened by 2 bps to +22 ◦ Implied volatility -- 2-year options on 10-year rates -- fell modestly to 98 bps of annual expected volatility • Nominal and option-adjusted spread curves flattened, reflecting the outperformance of higher coupons I. NOMINAL RMBS SPREADS REMAIN ATTRACTIVE(1) II. NOMINAL SPREAD CURVE IS STEEP, OAS CURVE FLAT(2)

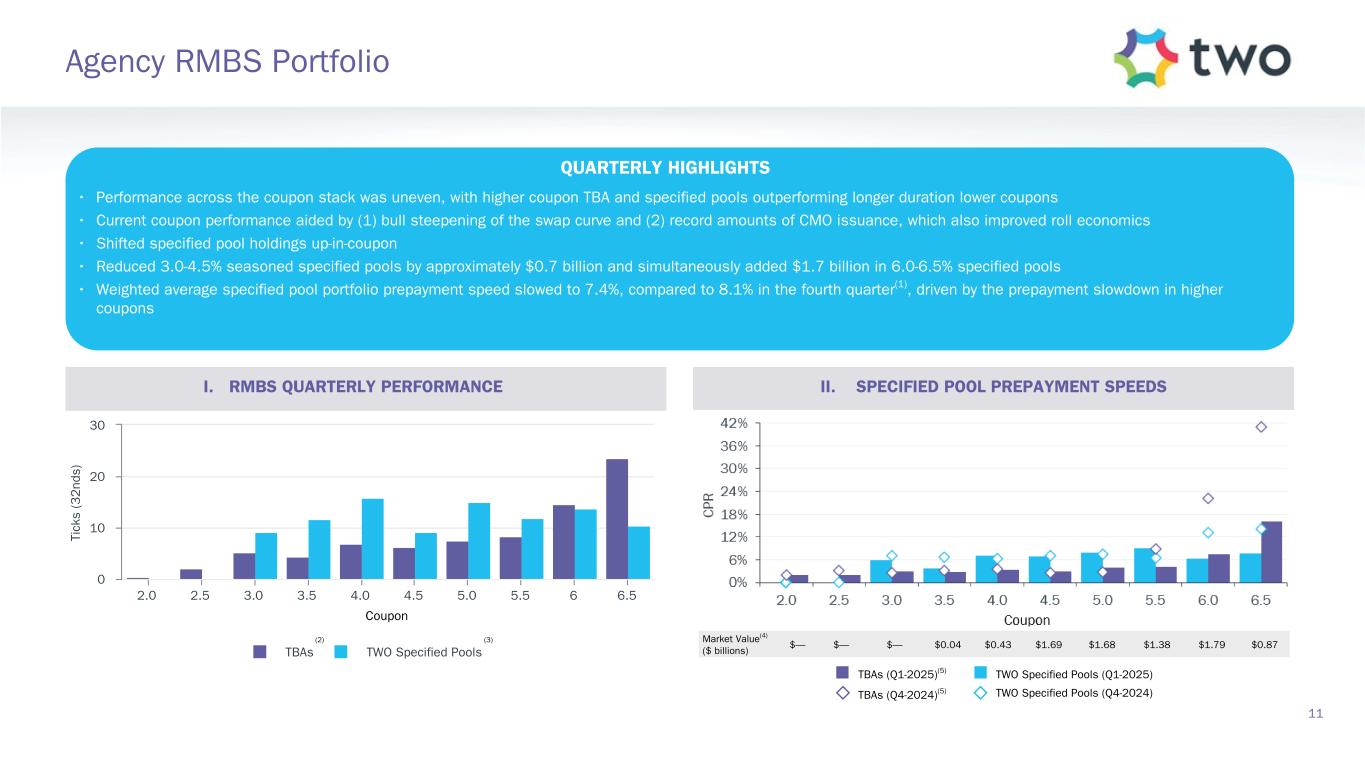

Coupon Ti ck s (3 2 nd s) TBAs TWO Specified Pools 2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6 6.5 0 10 20 30 TWO Specified Pools (Q1-2025)TBAs (Q1-2025)(5) TBAs (Q4-2024)(5) TWO Specified Pools (Q4-2024) Market Value(4) ($ billions) $— $— $— $0.04 $0.43 $1.69 $1.68 $1.38 $1.79 $0.87 11 Agency RMBS Portfolio I. RMBS QUARTERLY PERFORMANCE II. SPECIFIED POOL PREPAYMENT SPEEDS (2) (3) QUARTERLY HIGHLIGHTS • Performance across the coupon stack was uneven, with higher coupon TBA and specified pools outperforming longer duration lower coupons • Current coupon performance aided by (1) bull steepening of the swap curve and (2) record amounts of CMO issuance, which also improved roll economics • Shifted specified pool holdings up-in-coupon • Reduced 3.0-4.5% seasoned specified pools by approximately $0.7 billion and simultaneously added $1.7 billion in 6.0-6.5% specified pools • Weighted average specified pool portfolio prepayment speed slowed to 7.4%, compared to 8.1% in the fourth quarter(1), driven by the prepayment slowdown in higher coupons

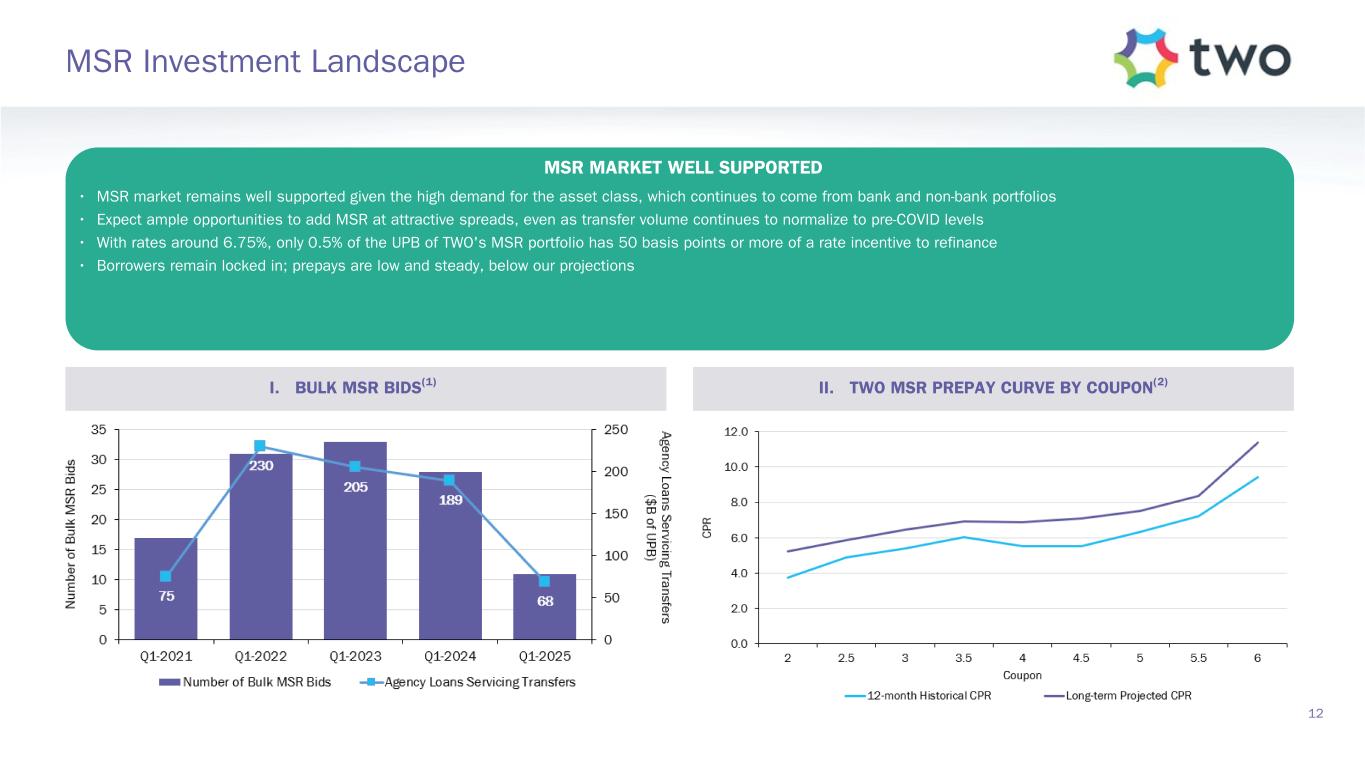

12 MSR Investment Landscape MSR MARKET WELL SUPPORTED • MSR market remains well supported given the high demand for the asset class, which continues to come from bank and non-bank portfolios • Expect ample opportunities to add MSR at attractive spreads, even as transfer volume continues to normalize to pre-COVID levels • With rates around 6.75%, only 0.5% of the UPB of TWO's MSR portfolio has 50 basis points or more of a rate incentive to refinance • Borrowers remain locked in; prepays are low and steady, below our projections I. BULK MSR BIDS(1) II. TWO MSR PREPAY CURVE BY COUPON(2)

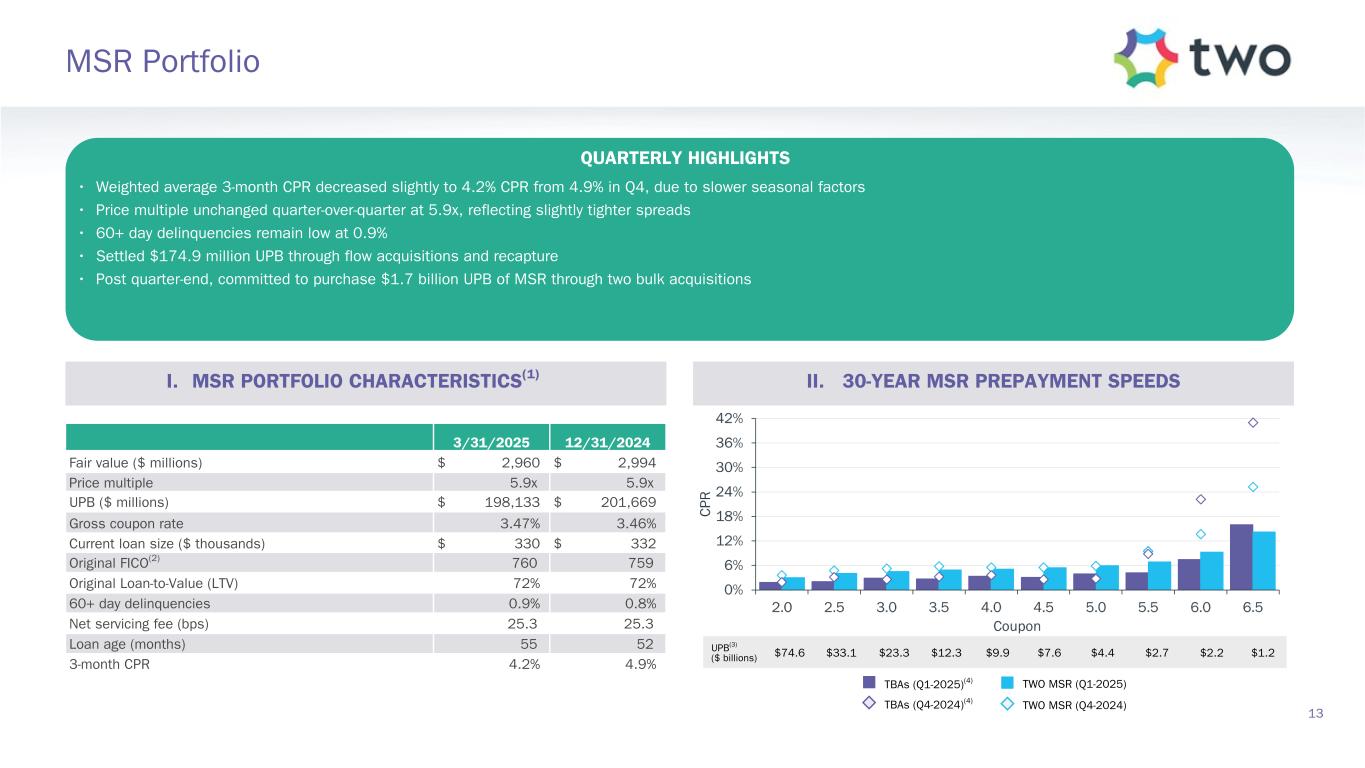

UPB(3) ($ billions) $74.6 $33.1 $23.3 $12.3 $9.9 $7.6 $4.4 $2.7 $2.2 $1.2 QUARTERLY HIGHLIGHTS • Weighted average 3-month CPR decreased slightly to 4.2% CPR from 4.9% in Q4, due to slower seasonal factors • Price multiple unchanged quarter-over-quarter at 5.9x, reflecting slightly tighter spreads • 60+ day delinquencies remain low at 0.9% • Settled $174.9 million UPB through flow acquisitions and recapture • Post quarter-end, committed to purchase $1.7 billion UPB of MSR through two bulk acquisitions 3/31/2025 12/31/2024 Fair value ($ millions) $ 2,960 $ 2,994 Price multiple 5.9x 5.9x UPB ($ millions) $ 198,133 $ 201,669 Gross coupon rate 3.47 % 3.46 % Current loan size ($ thousands) $ 330 $ 332 Original FICO(2) 760 759 Original Loan-to-Value (LTV) 72 % 72 % 60+ day delinquencies 0.9 % 0.8 % Net servicing fee (bps) 25.3 25.3 Loan age (months) 55 52 3-month CPR 4.2 % 4.9 % TWO MSR (Q1-2025)TBAs (Q1-2025)(4) TBAs (Q4-2024)(4) TWO MSR (Q4-2024) 13 MSR Portfolio I. MSR PORTFOLIO CHARACTERISTICS(1) II. 30-YEAR MSR PREPAYMENT SPEEDS

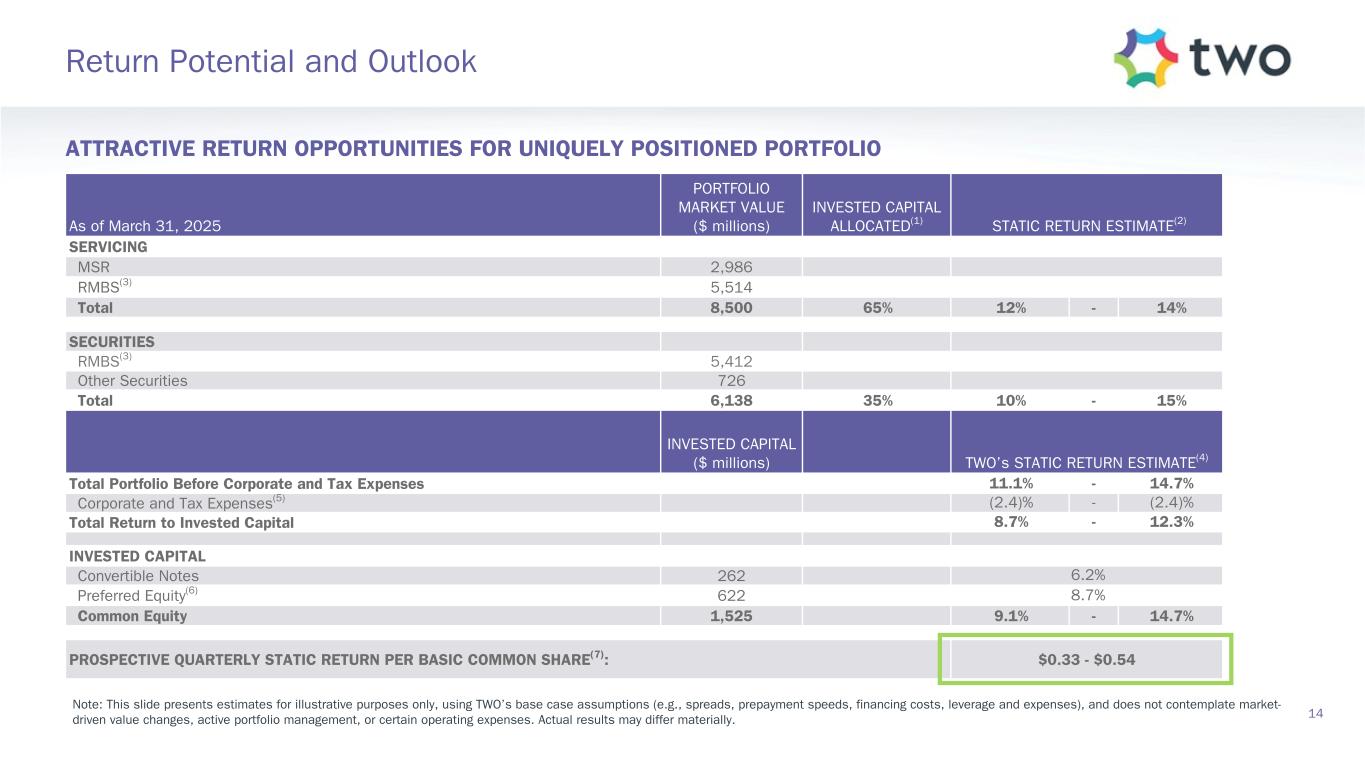

14 Return Potential and Outlook ATTRACTIVE RETURN OPPORTUNITIES FOR UNIQUELY POSITIONED PORTFOLIO As of March 31, 2025 PORTFOLIO MARKET VALUE ($ millions) INVESTED CAPITAL ALLOCATED(1) STATIC RETURN ESTIMATE(2) SERVICING MSR 2,986 RMBS(3) 5,514 Total 8,500 65% 12% - 14% SECURITIES RMBS(3) 5,412 Other Securities 726 Total 6,138 35% 10% - 15% INVESTED CAPITAL ($ millions) TWO’s STATIC RETURN ESTIMATE(4) Total Portfolio Before Corporate and Tax Expenses 11.1% - 14.7% Corporate and Tax Expenses(5) (2.4)% - (2.4)% Total Return to Invested Capital 8.7% - 12.3% INVESTED CAPITAL Convertible Notes 262 6.2% Preferred Equity(6) 622 8.7% Common Equity 1,525 9.1% - 14.7% PROSPECTIVE QUARTERLY STATIC RETURN PER BASIC COMMON SHARE(7): $0.33 - $0.54 Note: This slide presents estimates for illustrative purposes only, using TWO’s base case assumptions (e.g., spreads, prepayment speeds, financing costs, leverage and expenses), and does not contemplate market- driven value changes, active portfolio management, or certain operating expenses. Actual results may differ materially.

15 The TWO Advantage Our size, expertise, and investment strategy differentiate us from other mREIT peers and investors in MSR. Market Presence: Our scale, expertise and ability to leverage our own servicer allows us to find attractive incremental investments in hedged MSR. Investment Strategy: Our portfolio is focused on hedged MSR. Ongoing enhancements at RoundPoint uniquely position us to share our return profile beyond just owning Agency RMBS. Market Environment: Our MSR is hundreds of basis points out of the money from being able to refinance, keeping prepayment risk low and generating stable cashflows over a wide range of market scenarios. Financing and Liquidity: We have a strong balance sheet and diversified financing for both MSR and Agency RMBS.

Appendix

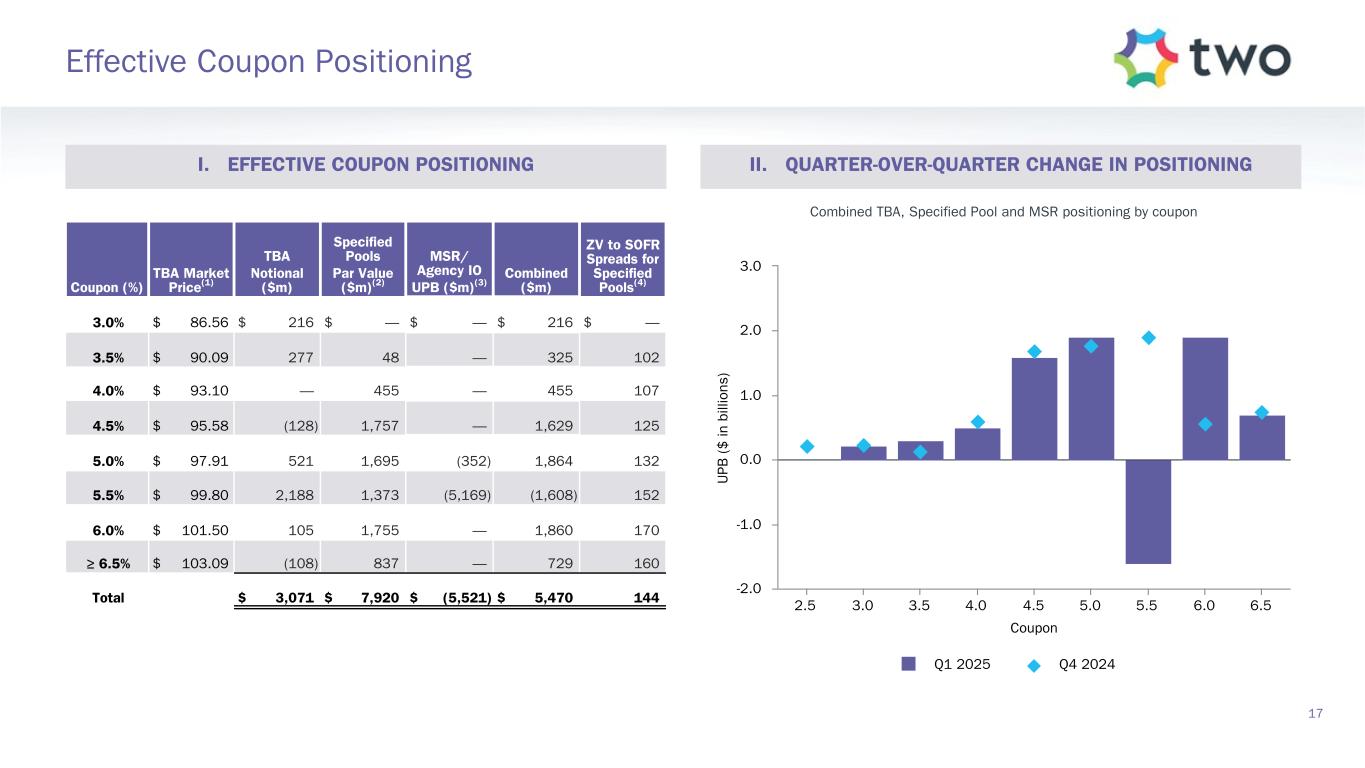

Coupon (%) TBA Market Price(1) TBA Notional ($m) Specified Pools Par Value ($m)(2) MSR/ Agency IO UPB ($m)(3) Combined ($m) ZV to SOFR Spreads for Specified Pools(4) 3.0% $ 86.56 $ 216 $ — $ — $ 216 $ — 3.5% $ 90.09 277 48 — 325 102 4.0% $ 93.10 — 455 — 455 107 4.5% $ 95.58 (128) 1,757 — 1,629 125 5.0% $ 97.91 521 1,695 (352) 1,864 132 5.5% $ 99.80 2,188 1,373 (5,169) (1,608) 152 6.0% $ 101.50 105 1,755 — 1,860 170 ≥ 6.5% $ 103.09 (108) 837 — 729 160 Total $ 3,071 $ 7,920 $ (5,521) $ 5,470 144 17 Effective Coupon Positioning Coupon U PB ( $ in b ill io ns ) Q1 2025 Q4 2024 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0 6.5 -2.0 -1.0 0.0 1.0 2.0 3.0 II. QUARTER-OVER-QUARTER CHANGE IN POSITIONINGI. EFFECTIVE COUPON POSITIONING Combined TBA, Specified Pool and MSR positioning by coupon

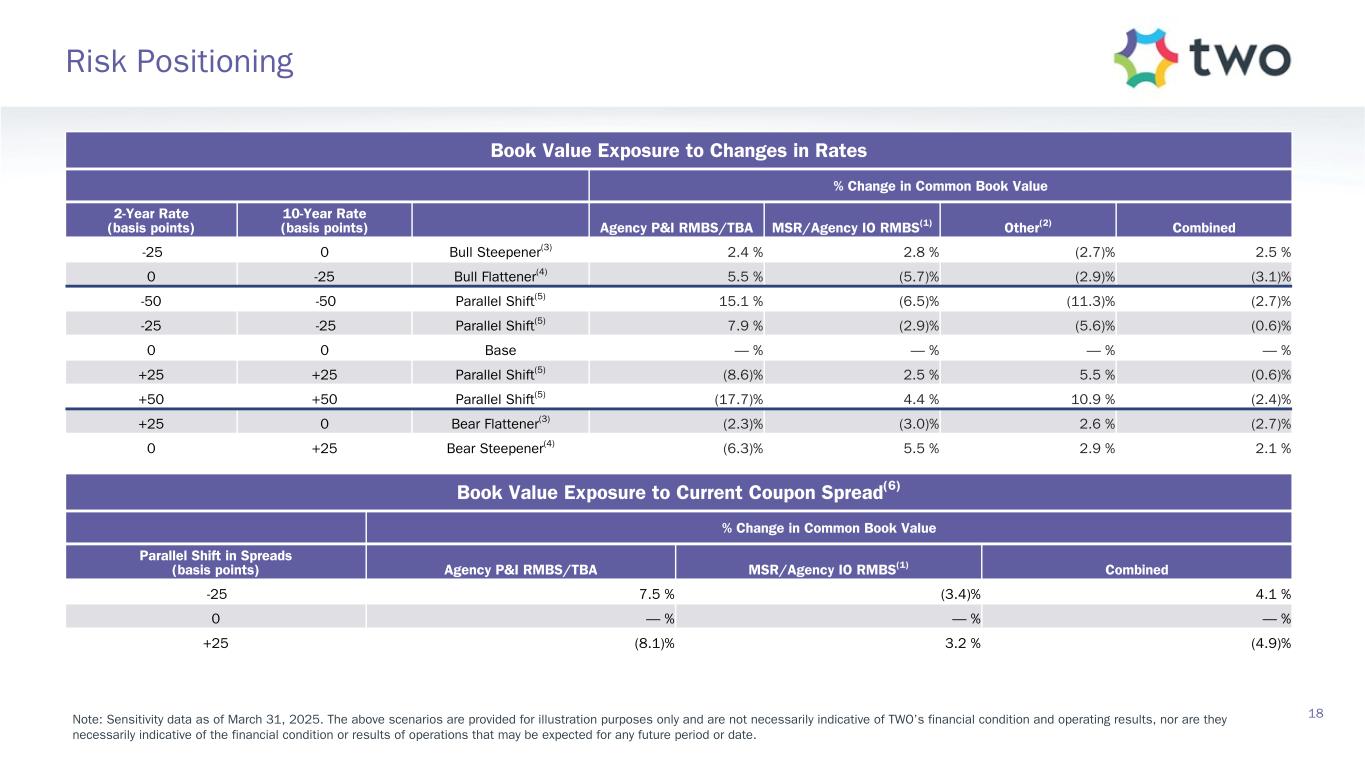

Note: Sensitivity data as of March 31, 2025. The above scenarios are provided for illustration purposes only and are not necessarily indicative of TWO’s financial condition and operating results, nor are they necessarily indicative of the financial condition or results of operations that may be expected for any future period or date. Book Value Exposure to Changes in Rates % Change in Common Book Value 2-Year Rate (basis points) 10-Year Rate (basis points) Agency P&I RMBS/TBA MSR/Agency IO RMBS(1) Other(2) Combined -25 0 Bull Steepener(3) 2.4 % 2.8 % (2.7) % 2.5 % 0 -25 Bull Flattener(4) 5.5 % (5.7) % (2.9) % (3.1) % -50 -50 Parallel Shift(5) 15.1 % (6.5) % (11.3) % (2.7) % -25 -25 Parallel Shift(5) 7.9 % (2.9) % (5.6) % (0.6) % 0 0 Base — % — % — % — % +25 +25 Parallel Shift(5) (8.6) % 2.5 % 5.5 % (0.6) % +50 +50 Parallel Shift(5) (17.7) % 4.4 % 10.9 % (2.4) % +25 0 Bear Flattener(3) (2.3) % (3.0) % 2.6 % (2.7) % 0 +25 Bear Steepener(4) (6.3) % 5.5 % 2.9 % 2.1 % Book Value Exposure to Current Coupon Spread(6) % Change in Common Book Value Parallel Shift in Spreads (basis points) Agency P&I RMBS/TBA MSR/Agency IO RMBS(1) Combined -25 7.5 % (3.4) % 4.1 % 0 — % — % — % +25 (8.1) % 3.2 % (4.9) % 18 Risk Positioning

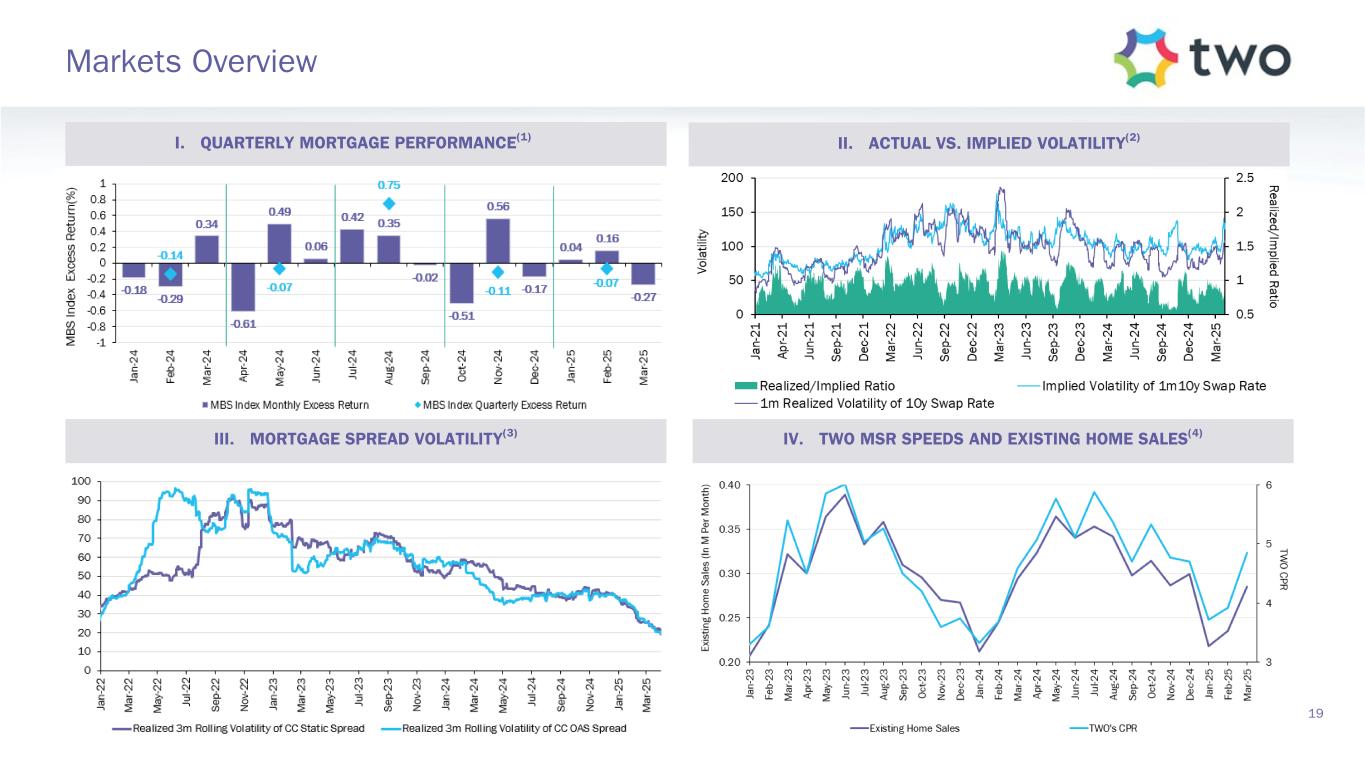

19 Markets Overview I. QUARTERLY MORTGAGE PERFORMANCE(1) II. ACTUAL VS. IMPLIED VOLATILITY(2) III. MORTGAGE SPREAD VOLATILITY(3) IV. TWO MSR SPEEDS AND EXISTING HOME SALES(4)

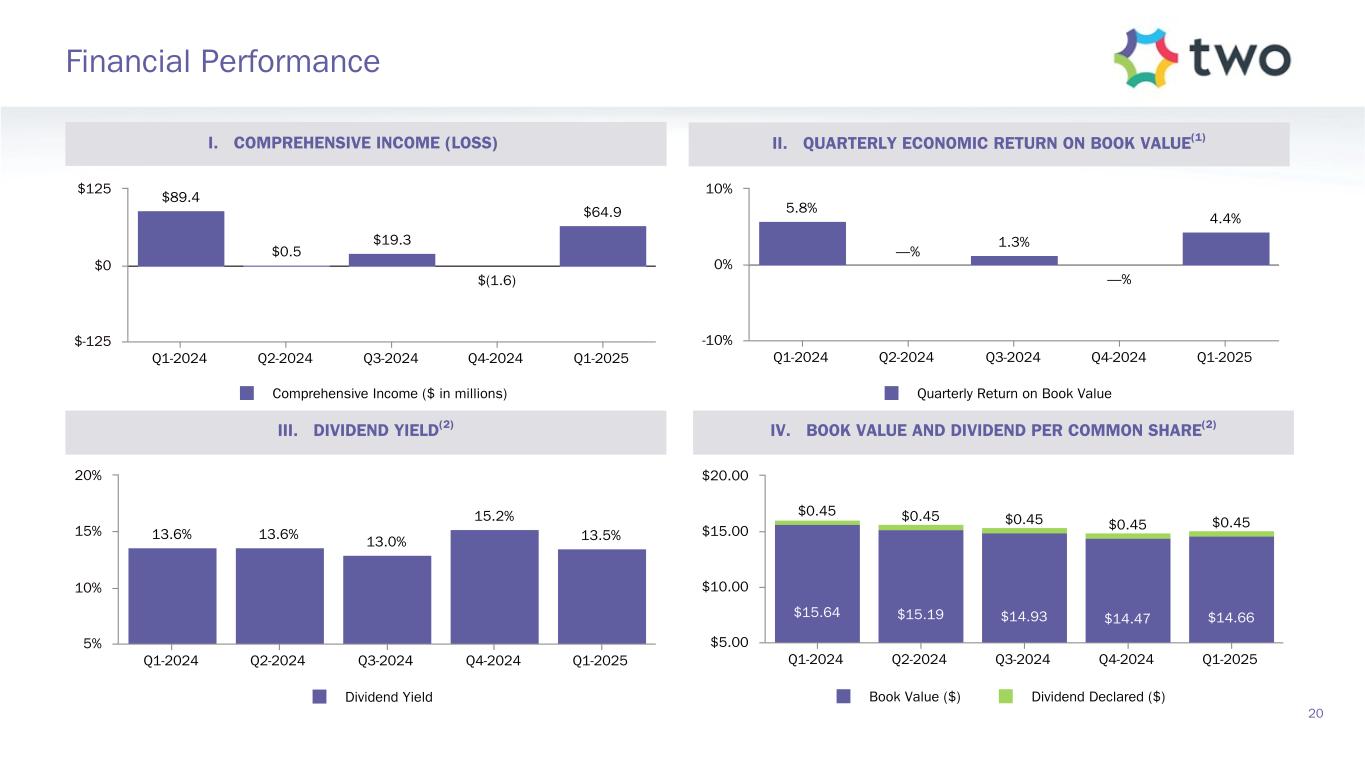

$89.4 $0.5 $19.3 $(1.6) $64.9 Comprehensive Income ($ in millions) Q1-2024 Q2-2024 Q3-2024 Q4-2024 Q1-2025 $-125 $0 $125 $15.64 $15.19 $14.93 $14.47 $14.66 $0.45 $0.45 $0.45 $0.45 $0.45 Book Value ($) Dividend Declared ($) Q1-2024 Q2-2024 Q3-2024 Q4-2024 Q1-2025 $5.00 $10.00 $15.00 $20.00 5.8% —% 1.3% —% 4.4% Quarterly Return on Book Value Q1-2024 Q2-2024 Q3-2024 Q4-2024 Q1-2025 -10% 0% 10% 13.6% 13.6% 13.0% 15.2% 13.5% Dividend Yield Q1-2024 Q2-2024 Q3-2024 Q4-2024 Q1-2025 5% 10% 15% 20% 20 Financial Performance I. COMPREHENSIVE INCOME (LOSS) II. QUARTERLY ECONOMIC RETURN ON BOOK VALUE(1) III. DIVIDEND YIELD(2) IV. BOOK VALUE AND DIVIDEND PER COMMON SHARE(2)

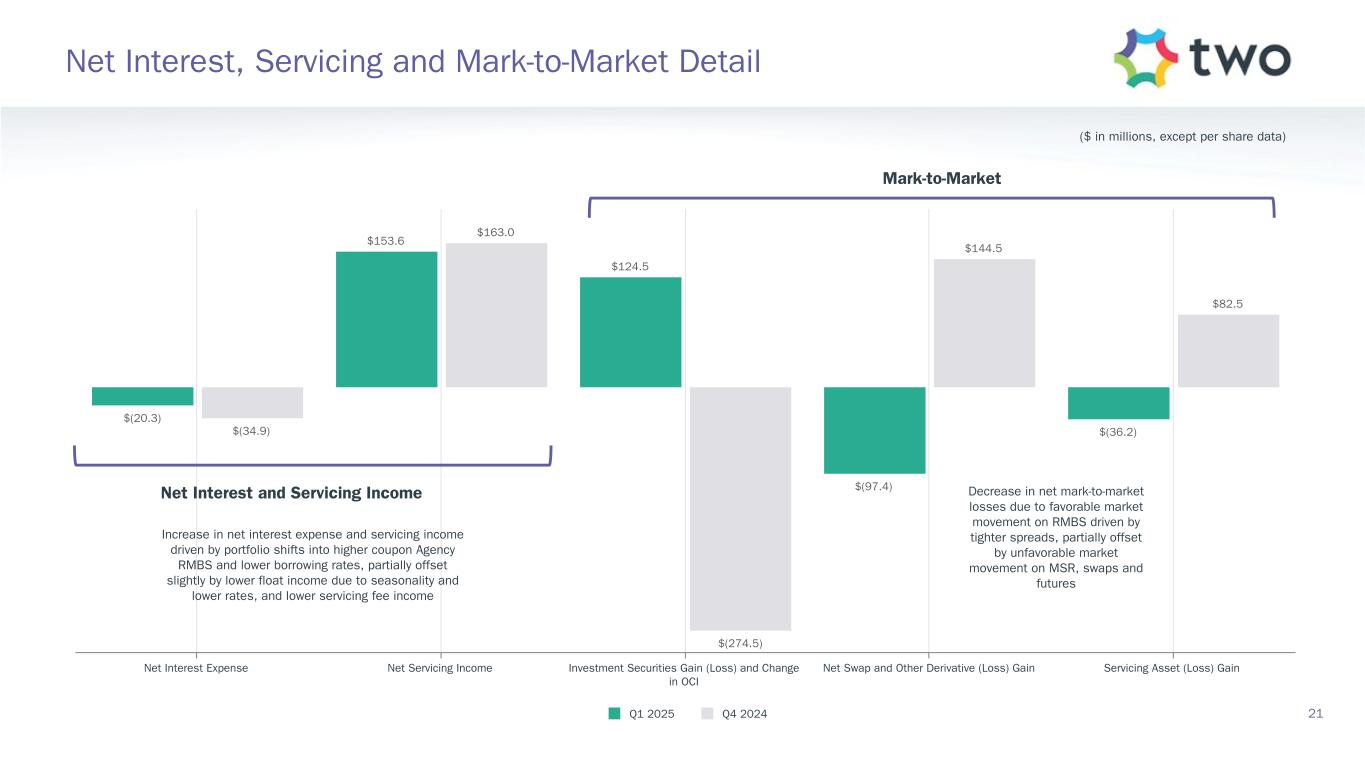

$(20.3) $153.6 $124.5 $(97.4) $(36.2)$(34.9) $163.0 $(274.5) $144.5 $82.5 Q1 2025 Q4 2024 Net Interest Expense Net Servicing Income Investment Securities Gain (Loss) and Change in OCI Net Swap and Other Derivative (Loss) Gain Servicing Asset (Loss) Gain Net Interest and Servicing Income Net Interest, Servicing and Mark-to-Market Detail 21 ($ in millions, except per share data) Mark-to-Market Increase in net interest expense and servicing income driven by portfolio shifts into higher coupon Agency RMBS and lower borrowing rates, partially offset slightly by lower float income due to seasonality and lower rates, and lower servicing fee income Decrease in net mark-to-market losses due to favorable market movement on RMBS driven by tighter spreads, partially offset by unfavorable market movement on MSR, swaps and futures

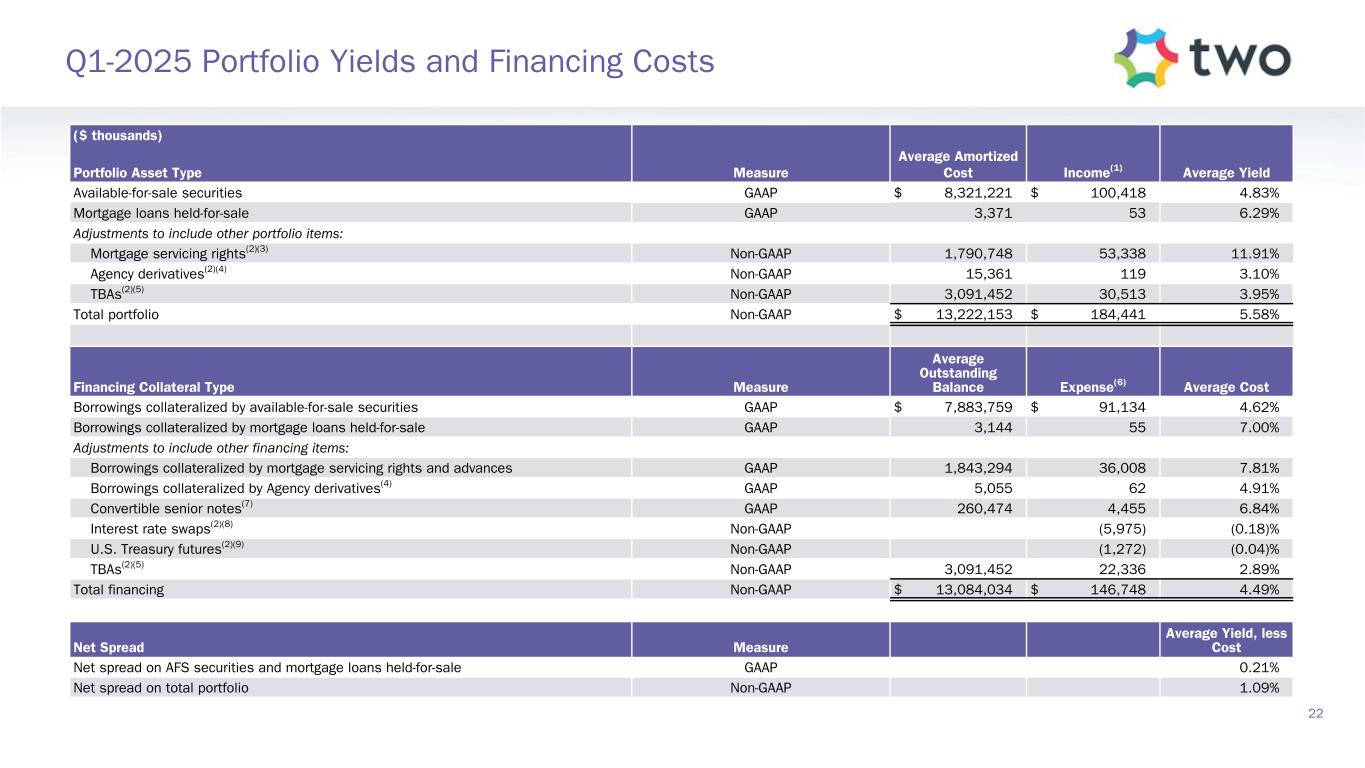

($ thousands) Portfolio Asset Type Measure Average Amortized Cost Income(1) Average Yield Available-for-sale securities GAAP $ 8,321,221 $ 100,418 4.83% Mortgage loans held-for-sale GAAP 3,371 53 6.29% Adjustments to include other portfolio items: Mortgage servicing rights(2)(3) Non-GAAP 1,790,748 53,338 11.91% Agency derivatives(2)(4) Non-GAAP 15,361 119 3.10 % TBAs(2)(5) Non-GAAP 3,091,452 30,513 3.95 % Total portfolio Non-GAAP $ 13,222,153 $ 184,441 5.58% Financing Collateral Type Measure Average Outstanding Balance Expense(6) Average Cost Borrowings collateralized by available-for-sale securities GAAP $ 7,883,759 $ 91,134 4.62% Borrowings collateralized by mortgage loans held-for-sale GAAP 3,144 55 7.00 % Adjustments to include other financing items: Borrowings collateralized by mortgage servicing rights and advances GAAP 1,843,294 36,008 7.81 % Borrowings collateralized by Agency derivatives(4) GAAP 5,055 62 4.91 % Convertible senior notes(7) GAAP 260,474 4,455 6.84 % Interest rate swaps(2)(8) Non-GAAP (5,975) (0.18) % U.S. Treasury futures(2)(9) Non-GAAP (1,272) (0.04) % TBAs(2)(5) Non-GAAP 3,091,452 22,336 2.89 % Total financing Non-GAAP $ 13,084,034 $ 146,748 4.49 % Net Spread Measure Average Yield, less Cost Net spread on AFS securities and mortgage loans held-for-sale GAAP 0.21% Net spread on total portfolio Non-GAAP 1.09% 22 Q1-2025 Portfolio Yields and Financing Costs

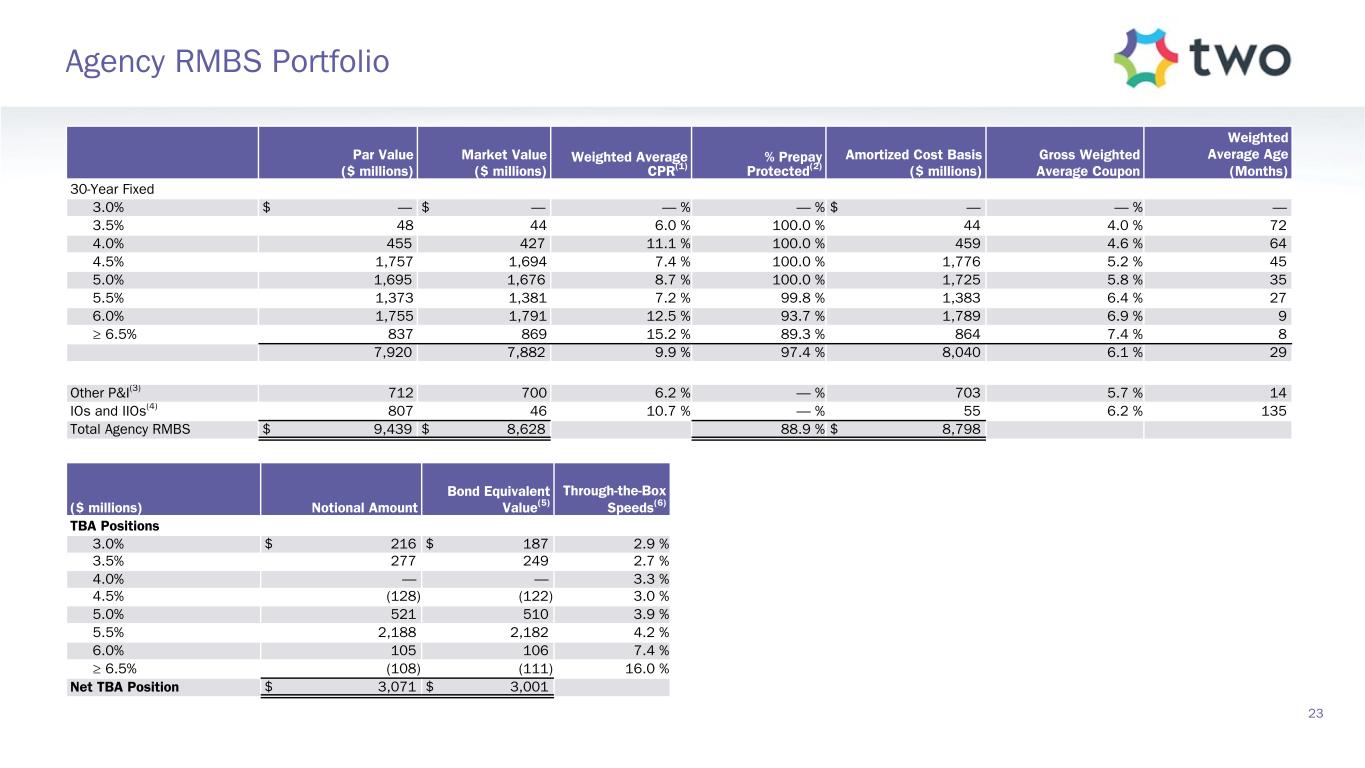

Par Value ($ millions) Market Value ($ millions) Weighted Average CPR(1) % Prepay Protected(2) Amortized Cost Basis ($ millions) Gross Weighted Average Coupon Weighted Average Age (Months) 30-Year Fixed 3.0% $ — $ — — % — % $ — — % — 3.5% 48 44 6.0 % 100.0 % 44 4.0 % 72 4.0% 455 427 11.1 % 100.0 % 459 4.6 % 64 4.5% 1,757 1,694 7.4 % 100.0 % 1,776 5.2 % 45 5.0% 1,695 1,676 8.7 % 100.0 % 1,725 5.8 % 35 5.5% 1,373 1,381 7.2 % 99.8 % 1,383 6.4 % 27 6.0% 1,755 1,791 12.5 % 93.7 % 1,789 6.9 % 9 ≥ 6.5% 837 869 15.2 % 89.3 % 864 7.4 % 8 7,920 7,882 9.9 % 97.4 % 8,040 6.1 % 29 Other P&I(3) 712 700 6.2 % — % 703 5.7 % 14 IOs and IIOs(4) 807 46 10.7 % — % 55 6.2 % 135 Total Agency RMBS $ 9,439 $ 8,628 88.9 % $ 8,798 ($ millions) Notional Amount Bond Equivalent Value(5) Through-the-Box Speeds(6) TBA Positions 3.0% $ 216 $ 187 2.9 % 3.5% 277 249 2.7 % 4.0% — — 3.3 % 4.5% (128) (122) 3.0 % 5.0% 521 510 3.9 % 5.5% 2,188 2,182 4.2 % 6.0% 105 106 7.4 % ≥ 6.5% (108) (111) 16.0 % Net TBA Position $ 3,071 $ 3,001 23 Agency RMBS Portfolio

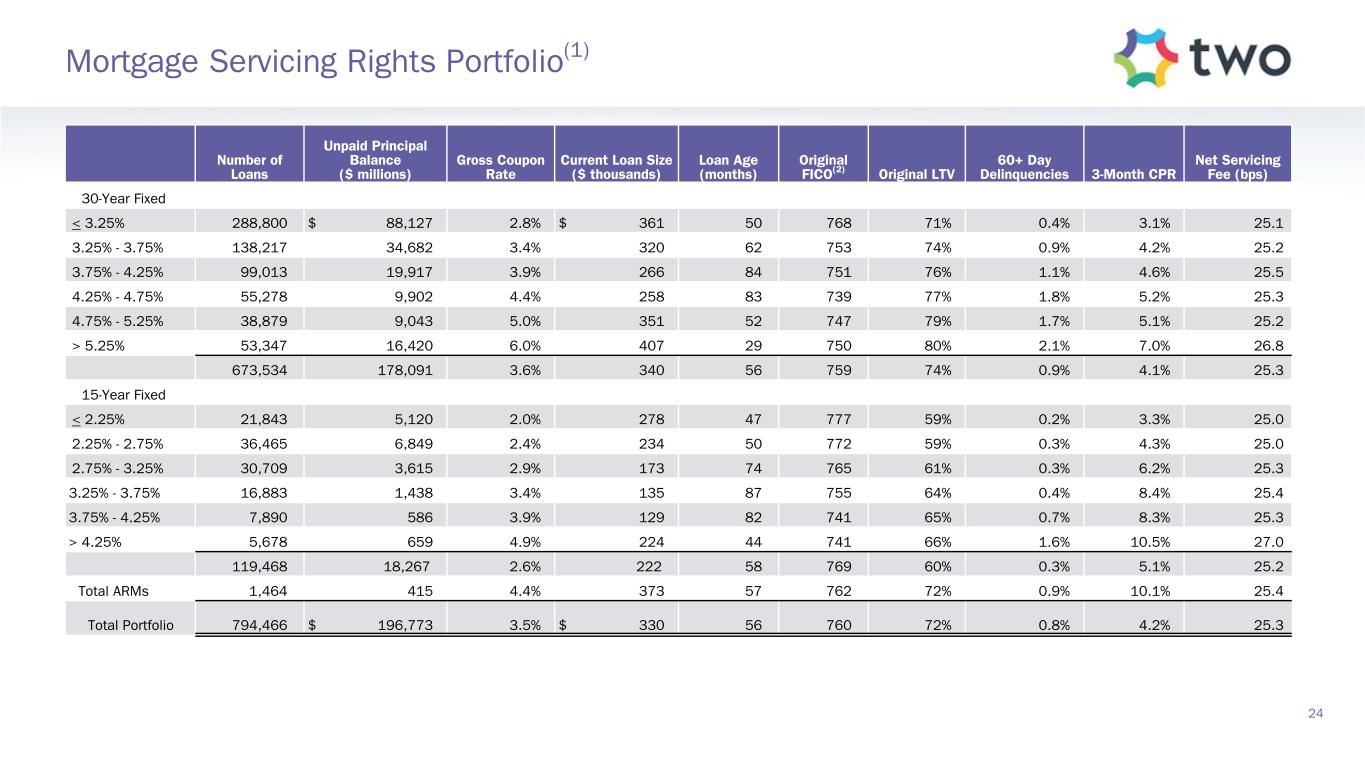

Number of Loans Unpaid Principal Balance ($ millions) Gross Coupon Rate Current Loan Size ($ thousands) Loan Age (months) Original FICO(2) Original LTV 60+ Day Delinquencies 3-Month CPR Net Servicing Fee (bps) 30-Year Fixed < 3.25% 288,800 $ 88,127 2.8% $ 361 50 768 71% 0.4% 3.1% 25.1 3.25% - 3.75% 138,217 34,682 3.4% 320 62 753 74% 0.9% 4.2% 25.2 3.75% - 4.25% 99,013 19,917 3.9 % 266 84 751 76 % 1.1 % 4.6 % 25.5 4.25% - 4.75% 55,278 9,902 4.4 % 258 83 739 77 % 1.8 % 5.2 % 25.3 4.75% - 5.25% 38,879 9,043 5.0 % 351 52 747 79 % 1.7 % 5.1 % 25.2 > 5.25% 53,347 16,420 6.0 % 407 29 750 80 % 2.1 % 7.0 % 26.8 673,534 178,091 3.6 % 340 56 759 74 % 0.9 % 4.1 % 25.3 15-Year Fixed < 2.25% 21,843 5,120 2.0 % 278 47 777 59 % 0.2 % 3.3 % 25.0 2.25% - 2.75% 36,465 6,849 2.4 % 234 50 772 59 % 0.3 % 4.3 % 25.0 2.75% - 3.25% 30,709 3,615 2.9 % 173 74 765 61 % 0.3 % 6.2 % 25.3 3.25% - 3.75% 16,883 1,438 3.4 % 135 87 755 64 % 0.4 % 8.4 % 25.4 3.75% - 4.25% 7,890 586 3.9 % 129 82 741 65 % 0.7 % 8.3 % 25.3 > 4.25% 5,678 659 4.9 % 224 44 741 66 % 1.6 % 10.5 % 27.0 119,468 18,267 2.6 % 222 58 769 60 % 0.3 % 5.1 % 25.2 Total ARMs 1,464 415 4.4 % 373 57 762 72 % 0.9 % 10.1 % 25.4 Total Portfolio 794,466 $ 196,773 3.5 % $ 330 56 760 72 % 0.8 % 4.2 % 25.3 24 Mortgage Servicing Rights Portfolio(1)

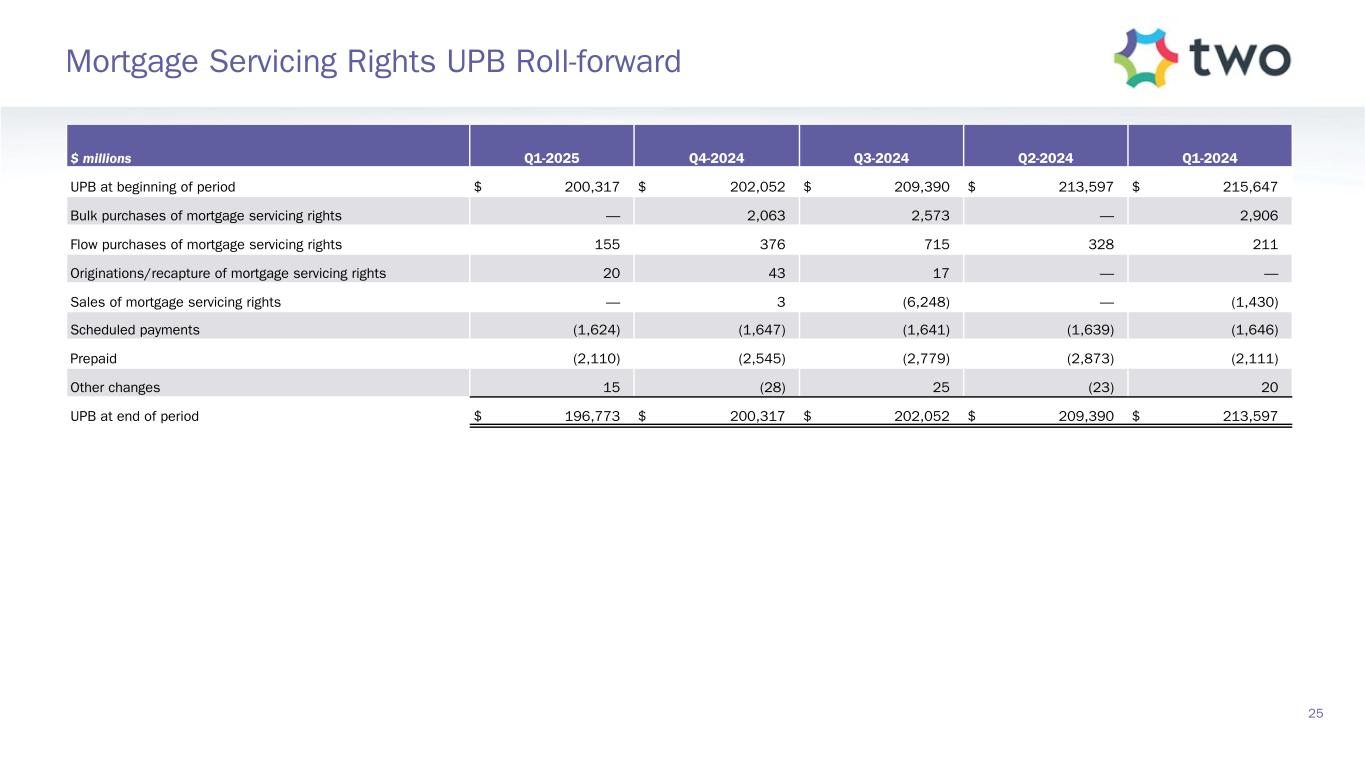

$ millions Q1-2025 Q4-2024 Q3-2024 Q2-2024 Q1-2024 UPB at beginning of period $ 200,317 $ 202,052 $ 209,390 $ 213,597 $ 215,647 Bulk purchases of mortgage servicing rights — 2,063 2,573 — 2,906 Flow purchases of mortgage servicing rights 155 376 715 328 211 Originations/recapture of mortgage servicing rights 20 43 17 — — Sales of mortgage servicing rights — 3 (6,248) — (1,430) Scheduled payments (1,624) (1,647) (1,641) (1,639) (1,646) Prepaid (2,110) (2,545) (2,779) (2,873) (2,111) Other changes 15 (28) 25 (23) 20 UPB at end of period $ 196,773 $ 200,317 $ 202,052 $ 209,390 $ 213,597 25 Mortgage Servicing Rights UPB Roll-forward

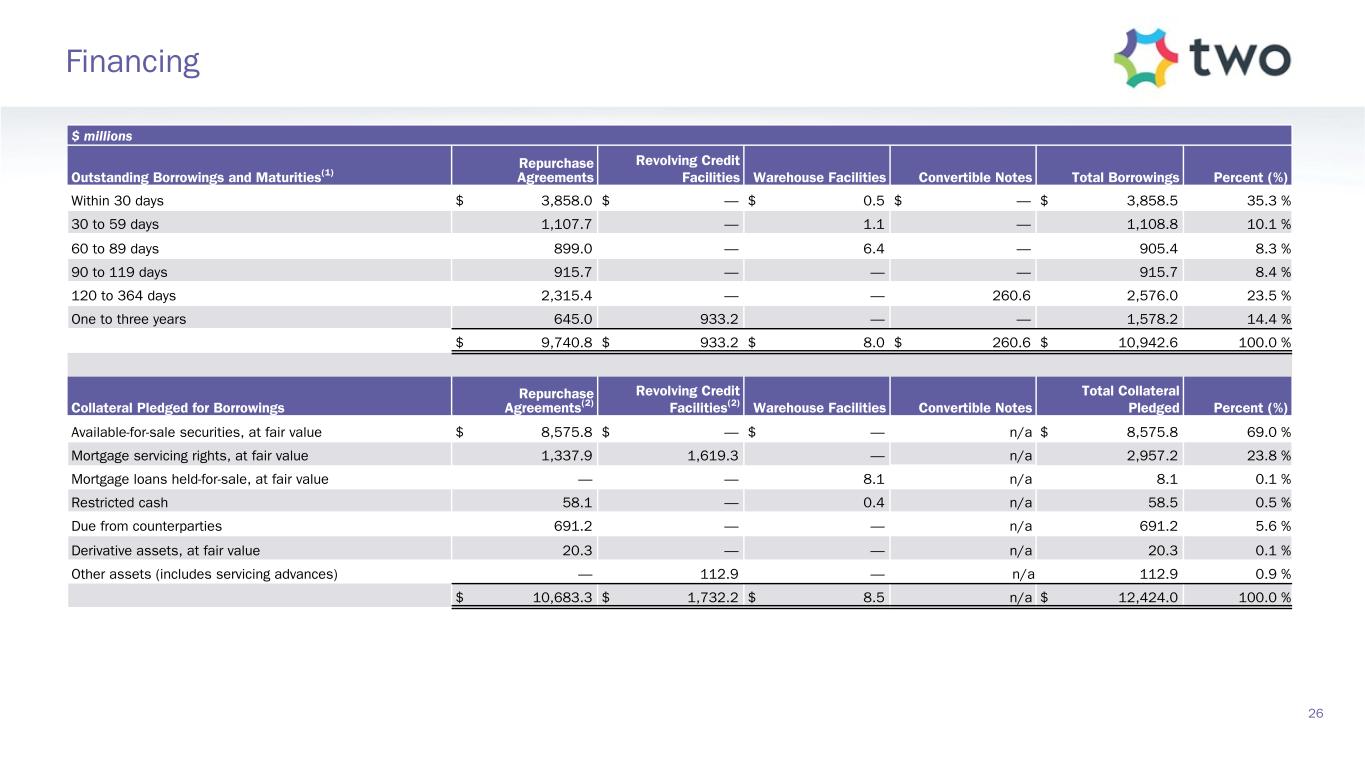

$ millions Outstanding Borrowings and Maturities(1) Repurchase Agreements Revolving Credit Facilities Warehouse Facilities Convertible Notes Total Borrowings Percent (%) Within 30 days $ 3,858.0 $ — $ 0.5 $ — $ 3,858.5 35.3 % 30 to 59 days 1,107.7 — 1.1 — 1,108.8 10.1 % 60 to 89 days 899.0 — 6.4 — 905.4 8.3 % 90 to 119 days 915.7 — — — 915.7 8.4 % 120 to 364 days 2,315.4 — — 260.6 2,576.0 23.5 % One to three years 645.0 933.2 — — 1,578.2 14.4 % $ 9,740.8 $ 933.2 $ 8.0 $ 260.6 $ 10,942.6 100.0 % Collateral Pledged for Borrowings Repurchase Agreements(2) Revolving Credit Facilities(2) Warehouse Facilities Convertible Notes Total Collateral Pledged Percent (%) Available-for-sale securities, at fair value $ 8,575.8 $ — $ — n/a $ 8,575.8 69.0 % Mortgage servicing rights, at fair value 1,337.9 1,619.3 — n/a 2,957.2 23.8 % Mortgage loans held-for-sale, at fair value — — 8.1 n/a 8.1 0.1 % Restricted cash 58.1 — 0.4 n/a 58.5 0.5 % Due from counterparties 691.2 — — n/a 691.2 5.6 % Derivative assets, at fair value 20.3 — — n/a 20.3 0.1 % Other assets (includes servicing advances) — 112.9 — n/a 112.9 0.9 % $ 10,683.3 $ 1,732.2 $ 8.5 n/a $ 12,424.0 100.0 % 26 Financing

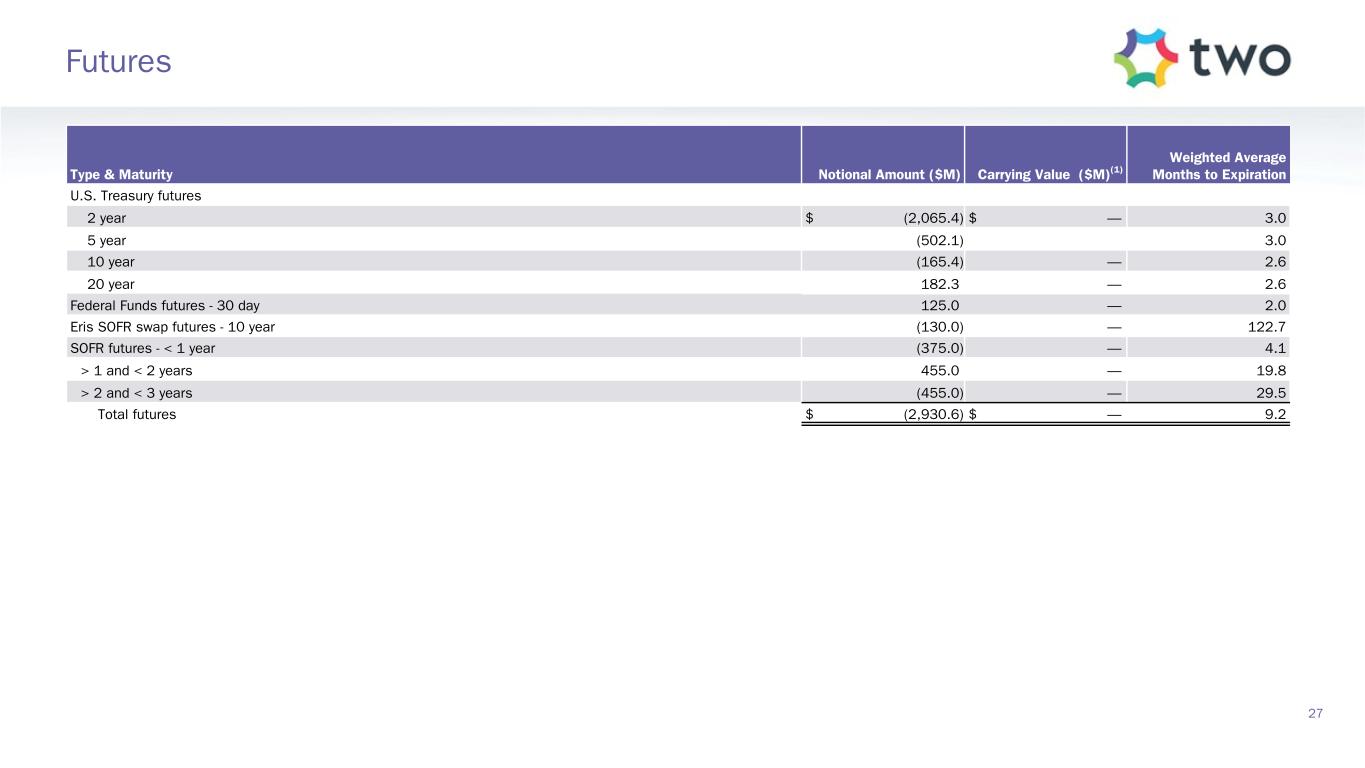

Type & Maturity Notional Amount ($M) Carrying Value ($M)(1) Weighted Average Months to Expiration U.S. Treasury futures 2 year $ (2,065.4) $ — 3.0 5 year (502.1) 3.0 10 year (165.4) — 2.6 20 year 182.3 — 2.6 Federal Funds futures - 30 day 125.0 — 2.0 Eris SOFR swap futures - 10 year (130.0) — 122.7 SOFR futures - < 1 year (375.0) — 4.1 > 1 and < 2 years 455.0 — 19.8 > 2 and < 3 years (455.0) — 29.5 Total futures $ (2,930.6) $ — 9.2 27 Futures

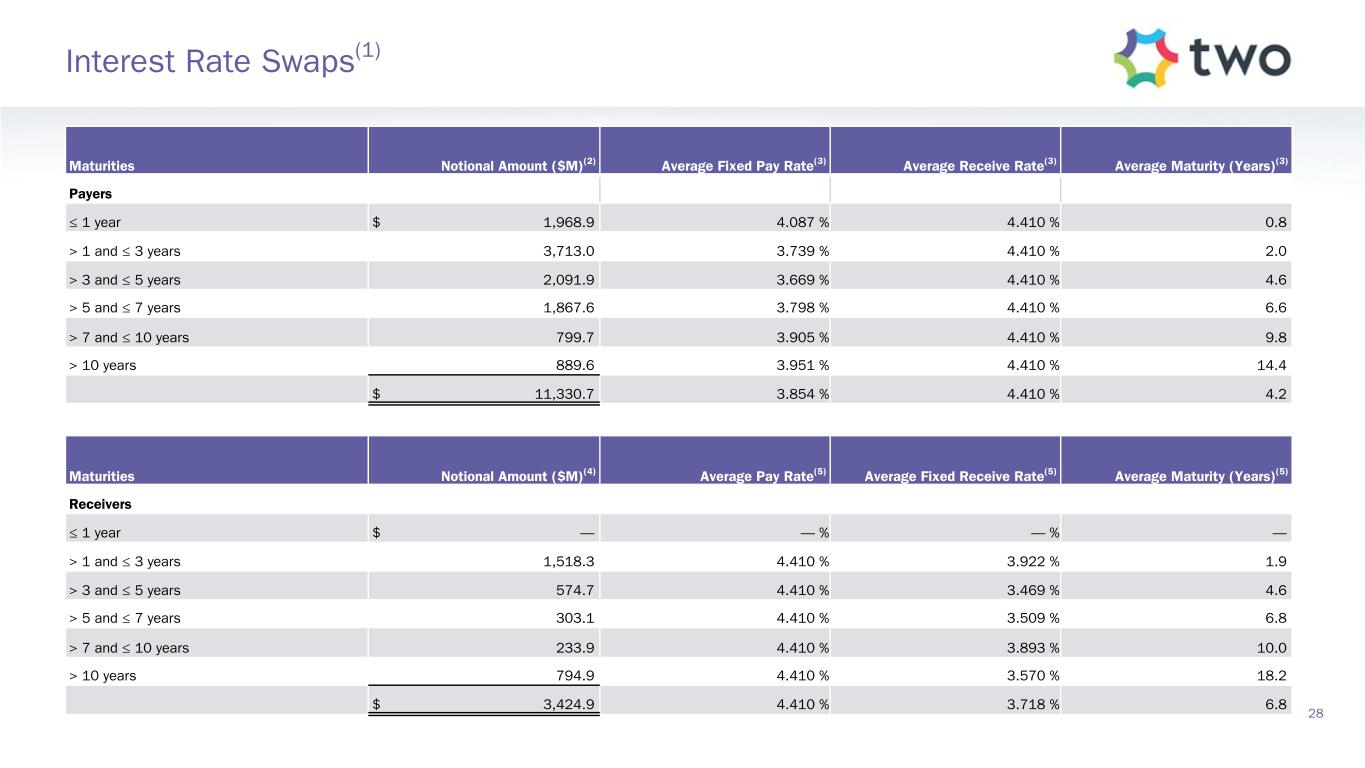

Maturities Notional Amount ($M)(2) Average Fixed Pay Rate(3) Average Receive Rate(3) Average Maturity (Years)(3) Payers ≤ 1 year $ 1,968.9 4.087 % 4.410 % 0.8 > 1 and ≤ 3 years 3,713.0 3.739 % 4.410 % 2.0 > 3 and ≤ 5 years 2,091.9 3.669 % 4.410 % 4.6 > 5 and ≤ 7 years 1,867.6 3.798 % 4.410 % 6.6 > 7 and ≤ 10 years 799.7 3.905 % 4.410 % 9.8 > 10 years 889.6 3.951 % 4.410 % 14.4 $ 11,330.7 3.854 % 4.410 % 4.2 Maturities Notional Amount ($M)(4) Average Pay Rate(5) Average Fixed Receive Rate(5) Average Maturity (Years)(5) Receivers ≤ 1 year $ — — % — % — > 1 and ≤ 3 years 1,518.3 4.410 % 3.922 % 1.9 > 3 and ≤ 5 years 574.7 4.410 % 3.469 % 4.6 > 5 and ≤ 7 years 303.1 4.410 % 3.509 % 6.8 > 7 and ≤ 10 years 233.9 4.410 % 3.893 % 10.0 > 10 years 794.9 4.410 % 3.570 % 18.2 $ 3,424.9 4.410 % 3.718 % 6.8 28 Interest Rate Swaps(1)

PAGE 3 - Quarterly Financials Overview 1. Economic return on book value is defined as the increase (decrease) in common book value from the beginning to the end of the given period, plus dividends declared to common stockholders in the period, divided by common book value as of the beginning of the period. 2. Includes $11.6 billion in settled positions and $3.0 billion net TBA position, which represents the bond equivalent value of the company’s TBA position. Bond equivalent value is defined as notional amount multiplied by market price. TBA contracts accounted for as derivative instruments in accordance with GAAP. For additional detail on the portfolio, see slides 11 and 13, and Appendix slides 23 and 24. 3. Economic debt-to-equity is defined as total borrowings to fund Agency and non-Agency investment securities, MSR and related servicing advances and mortgage loans held-for-sale, plus the implied debt on net TBA cost basis and net payable (receivable) for unsettled RMBS, divided by total equity. PAGE 4 - Markets Overview 1. Source: Bloomberg, as of the dates noted. 2. Source: Bloomberg, as of the dates noted. PAGE 5 - RoundPoint Operations Update 1. Data for loans in originations pipeline as of March 31, 2025. PAGE 6 - Book Value Summary 1. Economic return on book value is defined as the increase (decrease) in common book value from the beginning to the end of the given period, plus dividends declared to common stockholders in the period, divided by common book value as of the beginning of the period. PAGE 7 - Comprehensive Income Summary 1. Mark-to-Market Gains and Losses represents the sum of investment securities gain and change in OCI, net swap and other derivative losses, and servicing asset losses. See Appendix slide 21 for more detail. PAGE 8 - Financing Profile 1. Source: Bloomberg. Represents the average spread between repurchase rates and the Secured Overnight Financing Rate (SOFR) over trailing three-month and six-month periods between Q1 2021 and Q1 2025 (as of March 31, 2025). PAGE 9 - Portfolio Composition and Risk Positioning 1. For additional detail on the portfolio, see slides 11 and 13, and Appendix slides 23 and 24. 2. Net TBA position represents the bond equivalent value of the company’s TBA position. Bond equivalent value is defined as notional amount multiplied by market price. TBA contracts are accounted for as derivative instruments in accordance with GAAP. 3. Economic debt-to-equity is defined as total borrowings to fund Agency and non-Agency investment securities, MSR and related servicing advances and mortgage loans held-for-sale, plus the implied debt on net TBA cost basis and net payable (receivable) for unsettled RMBS, divided by total equity. 4. Interest rate exposure represents estimated change in common book value for theoretical parallel shift in interest rates. 5. Spread exposure represents estimated change in common book value for theoretical parallel shifts in spreads. PAGE 10 - Agency RMBS Investment Landscape 1. Source: J.P. Morgan DataQuery. Data is model-based and represents universal mortgage-backed securities (UMBS) generic TBA spreads as of the dates noted. In 2023, J.P. Morgan updated their model affecting only 2023 data. 2. Spreads produced using prepayment speeds generated with The Yield Book® Software using internally calibrated prepayment dials. Data as of March 31, 2025. ZV Spread stands for zero volatility spread. 29 End Notes

PAGE 11 - Agency RMBS Portfolio 1. Specified pools include securities with implicit or explicit prepayment protection, including lower loan balances (securities collateralized by loans less than or equal to $300K of initial principal balance), higher LTVs (securities collateralized by loans with greater than or equal to 80% LTV), certain geographic concentrations, loans secured by investor-owned properties, and lower FICO scores, as well as securities without such protection, including large bank-serviced and others. 2. Represents UMBS generic TBA performance during the quarter. 3. Specified pool performance excludes (1) certain coupons in which we were not invested for the full duration of the quarter and (2) certain coupons with de minimis balances. 4. Specified pool market value by coupon as of March 31, 2025. 5. Three-month prepayment speeds of delivered TBA contracts; average of J.P. Morgan, Bank of America, and Citi data. PAGE 12 - MSR Investment Landscape 1. Source: RiskSpan and TWO’s internal estimates as of March 31, 2025. 2. Generated with The Yield Book® Software using internally calibrated dials. MSR portfolio based on the prior month-end's principal balance of the loans underlying the company's MSR, increased for current month purchases and excluding unsettled MSR on loans for which the company is the named servicer as well as MSR on loans recently settled for which transfer to the company is not yet complete. PAGE 13 - MSR Portfolio 1. MSR portfolio based on the prior month-end's principal balance of the loans underlying the company's MSR, increased for current month purchases. Portfolio metrics, other than fair value and UPB, represent averages weighted by UPB. 2. FICO represents a mortgage industry accepted credit score of a borrower. 3. MSR portfolio based on the prior month-end's principal balance of the loans underlying the company's MSR, increased for current month purchases and excluding unsettled MSR on loans for which the company is the named servicer as well as MSR on loans recently settled for which transfer to the company is not yet complete. 4. Three-month prepayment speeds of delivered TBA contracts; average of J.P. Morgan, Bank of America, and Citi data. PAGE 14 - Return Potential and Outlook 1. Capital allocated represents management’s internal allocation. Certain financing balances and associated interest expenses are allocated between investments based on management’s assessment of leverage ratios and required capital or liquidity to support the investment. 2. Market return estimates reflect static assumptions using quarter-end spreads and market data. 3. Includes Agency pools and TBA positions. TBA contracts accounted for as derivative instruments in accordance with GAAP. 4. Estimated return on invested capital reflects static return assumptions using quarter-end portfolio valuations. 5. Total expenses includes operating expenses and tax expenses within the company’s taxable REIT subsidiaries. 6. Preferred equity coupon represents the 5-year yield along the forward curve to account for floating rate resets. 7. Prospective quarterly static return estimate per basic common share reflects portfolio performance expectations given current market conditions and represents the comprehensive income attributable to common stockholders (net of dividends on preferred stock). 30 End Notes (continued)

PAGE 17 - Effective Coupon Positioning 1. Represents UMBS TBA market prices as of March 31, 2025. 2. Specified pools include securities with implicit or explicit prepayment protection, including lower loan balances (securities collateralized by loans less than or equal to $300K of initial principal balance), higher LTVs (securities collateralized by loans with greater than or equal to 80% LTV), certain geographic concentrations, loans secured by investor-owned properties, and lower FICO scores, as well as securities without such protection, including large bank-serviced and others. 3. MSR/Agency IO represents an internally calculated exposure of a synthetic TBA position and the current coupon equivalents of our MSR, including the effect of unsettled MSR, and Agency IO RMBS. 4. Spreads generated with The Yield Book® Software using internally calibrated dials. PAGE 18 - Risk Positioning 1. MSR/Agency IO RMBS includes the effect of unsettled MSR. 2. Other includes all other derivative assets and liabilities and borrowings. Other excludes TBAs, which are included in the Agency P&I RMBS/TBA category. 3. Bull Steepener/Bear Flattener is a shift in short-term rates that represents estimated change in common book value for theoretical non-parallel shifts in the yield curve. Analysis uses a +/- 25 basis point shift in 2- year rates while holding long-term rates constant. 4. Bull Flattener/Bear Steepener is a shift in long-term rates that represents estimated change in common book value for theoretical non-parallel shifts in the yield curve. Analysis uses a +/- 25 basis point shift in 10- year rates while holding short-term rates constant. 5. Parallel shift represents estimated change in common book value for theoretical parallel shift in interest rates. 6. Book value exposure to current coupon spread represents estimated change in common book value for theoretical parallel shifts in spreads. PAGE 19 - Markets Overview 1. Source: Bloomberg, US MBS Index Monthly Treasury Excess Return data as of dates noted. 2. Source: Bloomberg, as of dates noted. 3. Source: J.P. Morgan DataQuery. 4. Monthly prepay speeds from National Association of Realtors via Bloomberg and RiskSpan as of March 31, 2025. MSR portfolio based on the prior month-end's principal balance of the loans underlying the company's MSR, increased for current month purchases and excluding unsettled MSR on loans for which the company is the named servicer as well as MSR on loans recently settled for which transfer to the company is not yet complete. PAGE 20 - Financial Performance 1. Economic return on book value is defined as the increase (decrease) in common book value from the beginning to the end of the given period, plus dividends declared to common stockholders in the period, divided by the common book value as of the beginning of the period. 2. Historical dividends may not be indicative of future dividend distributions. The company ultimately distributes dividends based on its taxable income per common share, not GAAP earnings. The annualized dividend yield on the company’s common stock is calculated based on the closing price of the last trading day of the relevant quarter. 31 End Notes (continued)

PAGE 22 - Q1-2025 Portfolio Yields and Financing Costs 1. Includes interest income, net of premium amortization/discount accretion, on Agency and non-Agency investment securities, servicing income, net of estimated amortization and servicing expenses, on MSR, and the implied asset yield portion of dollar roll income on TBAs. Amortization on MSR refers to the portion of change in fair value of MSR primarily attributed to the realization of expected cash flows (runoff) of the portfolio, which is deemed a non-GAAP measure due to the company’s decision to account for MSR at fair value. TBA dollar roll income is the non-GAAP economic equivalent to holding and financing Agency RMBS using short-term repurchase agreements. 2. As reported elsewhere in the company’s filings with the Securities and Exchange Commission, MSR, Agency derivatives, TBA, interest rate swap agreements and U.S. Treasury futures are reported at fair value in the company’s consolidated financial statements in accordance with GAAP, and the GAAP presentation and disclosure requirements for these items do not define or include the concepts of yield or cost of financing, amortized cost, or outstanding borrowings. 3. Amortized cost on MSR for a given period equals the net present value of the remaining future cash flows (obtained by applying original prepayment assumptions to the actual unpaid principal balance at the start of the period) using a discount rate equal to the original pricing yield. Original pricing yield is the discount rate which makes the net present value of the cash flows projected at purchase equal to the purchase price. MSR amortized cost is deemed a non-GAAP measure due to the company’s decision to account for MSR at fair value. 4. Represents inverse interest-only Agency RMBS which are accounted for as derivative instruments in accordance with GAAP. 5. Both the implied asset yield and implied financing benefit/cost of dollar roll income on TBAs are calculated using the average cost basis of TBAs as the denominator. TBA dollar roll income is the non-GAAP economic equivalent to holding and financing Agency RMBS using short-term repurchase agreements. TBAs are accounted for as derivative instruments in accordance with GAAP. 6. Includes interest expense and amortization of deferred debt issuance costs on borrowings under repurchase agreements (excluding those collateralized by U.S. Treasuries), revolving credit facilities, term notes payable and convertible senior notes, interest spread income/expense and amortization of upfront payments made or received upon entering into interest rate swap agreements, and the implied financing benefit/ cost portion of dollar roll income on TBAs. TBA dollar roll income is the non-GAAP economic equivalent to holding and financing Agency RMBS using short-term repurchase agreements. 7. Unsecured convertible senior notes. 8. The cost of financing on interest rate swaps held to mitigate interest rate risk associated with the company’s outstanding borrowings is calculated using average borrowings balance as the denominator. 9. The cost of financing on U.S. Treasury futures held to mitigate interest rate risk associated with the company’s outstanding borrowings is calculated using average borrowings balance as the denominator. U.S. Treasury futures income is the economic equivalent to holding and financing a relevant cheapest-to-deliver U.S. Treasury note or bond using short-term repurchase agreements. PAGE 23 - Agency RMBS Portfolio 1. Weighted average actual one-month CPR released at the beginning of the following month based on RMBS held as of the preceding month-end. 2. Determination of the percentage of prepay protected 30-year fixed Agency RMBS includes securities with implicit or explicit prepayment protection, including lower loan balances (securities collateralized by loans less than or equal to $300K of initial principal balance), higher LTVs (securities collateralized by loans with greater than or equal to 80% LTV), certain geographic concentrations, loans secured by investor-owned properties, and lower FICO scores. 3. Other P&I includes 15-year fixed, Hybrid ARMs, CMO and DUS pools. 4. IOs and IIOs represent market value of $24.4 million of Agency derivatives and $22.1 million of interest-only Agency RMBS. Agency derivatives are inverse interest-only Agency RMBS, which are accounted for as derivative instruments in accordance with GAAP. 5. Bond equivalent value is defined as the notional amount multiplied by market price. TBA contracts accounted for as derivative instruments in accordance with GAAP. 6. Three-month prepayment speeds of delivered TBA contracts; average of J.P. Morgan, Bank of America, and Citi data. PAGE 24 - Mortgage Servicing Rights Portfolio 1. MSR portfolio excludes residential mortgage loans for which the company is the named servicing administrator. Portfolio metrics, other than fair value and UPB, represent averages weighted by UPB. 2. FICO represents a mortgage industry-accepted credit score of a borrower. 32 End Notes (continued)

PAGE 26 - Financing 1. As of March 31, 2025, outstanding borrowings had a weighted average of 4.4 months to maturity. 2. Repurchase agreements and revolving credit facilities secured by MSR and/or other assets may be over-collateralized due to operational considerations. PAGE 27 - Futures 1. Exchange-traded derivative instruments (futures and options on futures) require the posting of an “initial margin” amount determined by the clearing exchange, which is generally intended to be set at a level sufficient to protect the exchange from the derivative instrument’s maximum estimated single-day price movement. The company also exchanges “variation margin” based upon daily changes in fair value, as measured by the exchange. The exchange of variation margin is considered a settlement of the derivative instrument, as opposed to pledged collateral. Accordingly, the receipt or payment of variation margin is accounted for as a direct reduction to the carrying value of the exchange-traded derivative asset or liability. PAGE 28 - Interest Rate Swaps 1. The company did not hold any interest rate swaptions at March 31, 2025. 2. Includes $2.5 billion notional amount of forward starting interest rate swaps. 3. Weighted averages exclude forward starting interest rate swaps. As of March 31, 2025, forward starting interest rate swap payers had a weighted average fixed pay rate of 3.9% and weighted average maturities of 5.5 years. 4. Includes $241.6 million notional amount of forward starting interest rate swaps. 5. Weighted averages exclude forward starting interest rate swaps. As of March 31, 2025, forward starting interest rate swap receivers had a weighted average fixed receive rate of 3.8% and weighted average maturities of 9.7 years. 33 End Notes (continued)